In the dynamic landscape of small businesses, understanding the intricacies of insurance is paramount. The right insurance coverage can provide a safety net, protecting your entrepreneurial venture from unforeseen circumstances. This comprehensive guide will delve into the world of Small Business Insurance, exploring its importance, various types, and the considerations that every small business owner should make.

The Significance of Small Business Insurance

Small businesses are the backbone of many economies, contributing significantly to innovation, job creation, and community development. However, they also face unique challenges and risks. From unexpected accidents to legal liabilities, the potential threats to a small business’s longevity are manifold. This is where Small Business Insurance steps in as a vital tool, offering protection and peace of mind.

Consider the story of Jane's Bakery, a thriving small business known for its delectable pastries. Despite Jane's meticulous attention to detail, an unexpected kitchen fire broke out one evening. The fire caused extensive damage, and the subsequent cleanup and repairs were costly. Without adequate insurance, Jane would have faced a financial burden that could have jeopardized the future of her business. However, thanks to her comprehensive insurance policy, she was able to quickly recover and reopen her bakery, showcasing the importance of Small Business Insurance in real-world scenarios.

Types of Small Business Insurance

The world of Small Business Insurance is diverse, offering a range of coverage options tailored to the specific needs of small enterprises. Here’s an overview of some essential types of insurance that every small business owner should consider:

General Liability Insurance

This is a fundamental coverage that every small business should have. It provides protection against third-party claims, including bodily injury, property damage, and personal and advertising injury. For instance, if a customer slips and falls in your store, general liability insurance can cover the associated medical costs and potential legal fees.

Property Insurance

Property insurance safeguards your business’s physical assets, such as buildings, equipment, inventory, and furnishings. In the event of damage caused by fires, storms, vandalism, or other covered perils, property insurance can help you rebuild and replace what’s been lost.

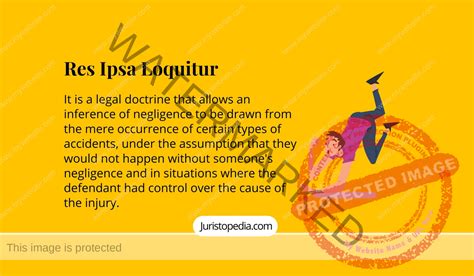

Professional Liability Insurance (Errors & Omissions Insurance)

Also known as E&O insurance, this coverage is essential for businesses offering professional services. It protects against claims of negligence, errors, or omissions that may result in financial loss for your clients. For instance, if a software consulting firm provides faulty code that leads to a client’s data loss, professional liability insurance can cover the associated costs.

Business Owner’s Policy (BOP)

A BOP is a cost-effective bundle that combines general liability and property insurance, along with additional coverages like business interruption insurance. It’s designed specifically for small businesses and can be customized to fit your unique needs.

Workers’ Compensation Insurance

If your business has employees, workers’ compensation insurance is a legal requirement in most states. It provides coverage for work-related injuries and illnesses, ensuring your employees receive the necessary medical care and financial support without impacting your business’s operations.

Cyber Liability Insurance

In today’s digital age, cyber threats are a real concern for businesses of all sizes. Cyber liability insurance can protect your business from the financial consequences of data breaches, hacking, and other cyber incidents. It can cover costs associated with legal fees, data recovery, and notifying affected parties.

Commercial Auto Insurance

If your business owns or leases vehicles, commercial auto insurance is a must. It provides coverage for bodily injury, property damage, and medical payments related to the use of your business vehicles.

Choosing the Right Coverage

Selecting the appropriate insurance coverage for your small business involves careful consideration of several factors. Here are some key steps to guide you through the process:

Identify Your Risks

Start by assessing the specific risks your business faces. Consider factors like your industry, location, number of employees, and the nature of your operations. Understanding these risks will help you determine the types of insurance you need and the coverage limits that are appropriate.

Research Insurance Providers

Take the time to research and compare different insurance providers. Look for companies that specialize in small business insurance and have a strong reputation for customer service and financial stability. Check online reviews and seek recommendations from other small business owners.

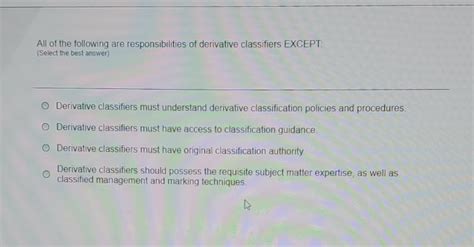

Tailor Your Coverage

Don’t settle for a one-size-fits-all approach. Work with your insurance agent to customize your policy based on your unique business needs. Consider add-on coverages or endorsements that address specific risks, such as product recall insurance or employment practices liability insurance.

Understand Exclusions and Limitations

Every insurance policy comes with certain exclusions and limitations. Make sure you thoroughly understand what’s covered and what’s not. This will help you identify any gaps in your coverage and make informed decisions about additional policies or endorsements.

Review and Update Regularly

Your business needs may change over time, so it’s important to review your insurance coverage annually or whenever significant changes occur. This ensures that your coverage remains up-to-date and adequately protects your business.

| Insurance Type | Coverage Highlights |

|---|---|

| General Liability | Third-party bodily injury, property damage, and personal/advertising injury claims. |

| Property Insurance | Protection for physical assets like buildings, equipment, and inventory. |

| Professional Liability | Coverage for negligence claims in professional services. |

| Business Owner's Policy (BOP) | Combines general liability and property insurance with additional coverages. |

| Workers' Compensation | Mandatory coverage for work-related injuries and illnesses. |

| Cyber Liability | Protection against data breaches and cyber incidents. |

| Commercial Auto | Coverage for business vehicles, including bodily injury and property damage. |

How much does small business insurance cost?

+The cost of small business insurance can vary widely depending on factors such as the type of business, its location, the number of employees, and the level of coverage needed. On average, small businesses can expect to pay anywhere from a few hundred to several thousand dollars per year for their insurance policies. It’s best to consult with an insurance agent to get a more accurate estimate based on your specific business needs.

Do I really need all these types of insurance?

+While not all businesses will require every type of insurance listed, it’s crucial to assess your unique risks and tailor your coverage accordingly. For example, if you have employees, workers’ compensation insurance is often a legal requirement. Similarly, if your business involves providing professional services, professional liability insurance is a must-have. Consult with an insurance expert to determine the right mix of coverages for your small business.

Can I get discounts on my small business insurance?

+Yes, there are often opportunities to save on small business insurance premiums. Some insurers offer discounts for bundling multiple policies, such as combining general liability and property insurance in a BOP. You may also qualify for discounts based on your business’s safety measures, loss control programs, or even your personal insurance history. Don’t hesitate to inquire about potential discounts when discussing coverage with your insurance provider.