Managing your paycheck effectively is crucial for financial stability and security. The Massachusetts Institute of Technology (MIT) offers various resources and guidelines to help its employees navigate the complexities of paycheck management. Here, we will delve into five valuable tips that can help MIT employees make the most out of their paychecks, ensuring a stable financial future.

Key Points

- Understanding your paycheck components to make informed decisions

- Utilizing tax-advantaged savings options for long-term benefits

- Managing debt effectively to minimize financial stress

- Building an emergency fund for unforeseen expenses

- Regularly reviewing and adjusting your financial strategy

Understanding Your Paycheck Components

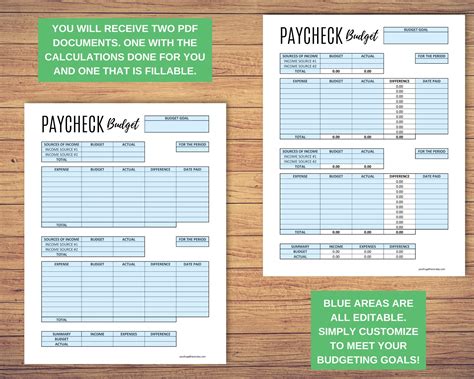

It’s essential to have a clear understanding of the various components that make up your paycheck. This includes your gross income, deductions, taxes, and net pay. MIT employees can access their paycheck details through the MIT Payroll system, which provides a detailed breakdown of each component. By understanding where your money is going, you can identify areas for potential savings and make informed decisions about your financial planning.

Tax-Advantaged Savings Options

MIT offers several tax-advantaged savings options, including 401(k) and 403(b) retirement plans, as well as Health Savings Accounts (HSAs) for employees with high-deductible health plans. Contributing to these accounts can help reduce your taxable income, lowering your tax liability while building a safety net for the future. For instance, contributing to a 401(k) plan can provide a tax deduction, while the funds grow tax-deferred, offering a significant long-term benefit.

| Retirement Plan | Contribution Limit |

|---|---|

| 401(k) | $19,500 (2023) |

| 403(b) | $19,500 (2023) |

| Health Savings Account (HSA) | $3,850 (single), $7,750 (family) (2023) |

Debt Management

Effectively managing debt is vital for maintaining financial health. High-interest debts, such as credit card balances, should be prioritized for repayment. MIT employees can consider consolidating debts into lower-interest loans or balance transfer credit cards. Creating a debt repayment plan, either through a budgeting app or with the help of a financial advisor, can provide a structured approach to becoming debt-free.

Building an Emergency Fund

An emergency fund serves as a financial safety net, covering unexpected expenses such as car repairs, medical bills, or temporary job loss. It’s recommended to save 3-6 months’ worth of living expenses in an easily accessible savings account. MIT employees can set up automatic transfers from their paychecks to their savings accounts, making it easier to build this fund over time.

Regular Financial Reviews

Financial situations and goals can change over time, making it essential to regularly review and adjust your financial strategy. MIT offers financial counseling services and resources to help employees make informed decisions about their paychecks and long-term financial planning. Regular reviews can help identify areas for improvement, ensure that financial goals are on track, and make adjustments as needed to stay aligned with changing financial priorities.

How often should I review my financial plan?

+It's recommended to review your financial plan at least annually, or whenever you experience a significant change in your financial situation, such as a job change, marriage, or the birth of a child.

What are the benefits of contributing to a tax-advantaged retirement plan?

+Contributing to a tax-advantaged retirement plan, such as a 401(k) or 403(b), can reduce your taxable income, lower your tax liability, and provide a dedicated source of funds for retirement, helping you achieve long-term financial security.

How can I prioritize my debts for repayment?

+Prioritize your debts by focusing on high-interest loans first, such as credit card balances. Consider consolidating debts into lower-interest loans or using the snowball method, where you pay off smaller debts first to build momentum and confidence in your debt repayment plan.

In conclusion, managing your paycheck effectively is a crucial aspect of financial planning. By understanding your paycheck components, utilizing tax-advantaged savings options, managing debt, building an emergency fund, and regularly reviewing your financial strategy, MIT employees can ensure a stable financial future. These strategies, combined with the resources and guidelines provided by MIT, offer a comprehensive approach to financial management, empowering employees to make informed decisions about their paychecks and secure their long-term financial well-being.