As a student, having access to affordable and comprehensive health insurance is crucial to ensure your well-being and peace of mind during your academic journey. With the rising costs of healthcare, finding low-cost student health insurance options can be a challenging task. In this comprehensive guide, we will explore the world of student health insurance, providing you with valuable insights, tips, and real-world examples to help you make informed decisions and secure the best coverage for your needs.

Understanding the Importance of Student Health Insurance

Student life is often filled with various activities, from intense study sessions to participating in extracurriculars and exploring new experiences. However, it’s essential to prioritize your health and well-being throughout this journey. Student health insurance plays a vital role in ensuring that you have access to quality healthcare services without incurring significant financial burdens.

Many students may underestimate the potential risks and expenses associated with unexpected illnesses or accidents. Without adequate insurance coverage, even a minor injury or illness can lead to costly medical bills, impacting your financial stability and academic performance. Student health insurance provides a safety net, offering financial protection and access to necessary medical care, allowing you to focus on your studies and personal growth.

Exploring Low-Cost Student Health Insurance Options

When it comes to finding low-cost student health insurance, it’s important to explore various options and compare different plans to identify the one that best suits your needs and budget. Here are some key considerations and strategies to help you navigate the world of student health insurance:

1. University-Provided Health Plans

Many universities and colleges offer their own health insurance plans specifically designed for students. These plans are often tailored to the unique needs of the student population and may include coverage for a wide range of medical services, including primary care, specialty care, prescription medications, and emergency services. University-provided plans can be a convenient and cost-effective option, as they are typically tailored to the local healthcare providers and facilities.

Research the specific details of your university's health plan, including coverage limits, deductibles, co-pays, and any exclusions. Compare these details with other insurance options to ensure you are getting the best value for your money. Additionally, inquire about any discounts or subsidies offered to students, as these can significantly reduce your insurance costs.

2. Private Insurance Companies

If your university does not offer a health plan or if you are looking for additional coverage options, private insurance companies provide a wide range of student-specific plans. These plans are designed to cater to the unique needs of students, offering flexible coverage and affordable premiums.

When exploring private insurance companies, consider factors such as network providers, coverage limits, and any additional benefits like dental or vision coverage. Compare multiple plans to find the one that offers the best balance between cost and comprehensive coverage. Look for companies that specialize in student health insurance, as they often have more flexible and student-friendly policies.

3. Government-Sponsored Programs

Depending on your country and eligibility, government-sponsored health insurance programs can be a valuable option for students. These programs, such as Medicaid or the Children’s Health Insurance Program (CHIP) in the United States, provide affordable or even free healthcare coverage to eligible individuals.

Research the specific requirements and eligibility criteria for these programs in your region. If you meet the criteria, enrolling in a government-sponsored program can provide you with essential healthcare coverage without the financial strain. Keep in mind that these programs may have certain limitations and restrictions, so thoroughly understand the details before making a decision.

4. Short-Term Insurance Plans

If you are only in need of temporary health insurance coverage, short-term insurance plans can be a cost-effective solution. These plans offer limited coverage for a specified period, typically ranging from a few months to a year. They are ideal for students who are in between insurance options or are studying abroad for a short period.

However, it's important to note that short-term insurance plans often have limited benefits and may not cover pre-existing conditions. Carefully review the terms and conditions of these plans to ensure they align with your healthcare needs. Additionally, consider the renewal options and whether the plan can be extended if necessary.

5. Student Health Insurance Comparison Websites

Navigating the world of student health insurance can be overwhelming, but fortunately, there are dedicated comparison websites that can simplify the process. These websites provide a comprehensive overview of various student health insurance plans, allowing you to compare features, costs, and coverage limits side by side.

Utilize these comparison websites to narrow down your options and find the best plan for your budget and needs. Look for websites that offer detailed explanations of each plan's features and any exclusions. Reading user reviews and testimonials can also provide valuable insights into the quality of service and customer satisfaction.

Analyzing Key Factors for Low-Cost Student Health Insurance

When selecting a low-cost student health insurance plan, it’s essential to consider various factors to ensure you are making an informed decision. Here are some key factors to analyze and evaluate:

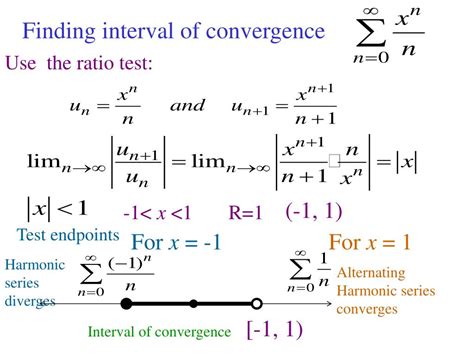

1. Coverage Limits and Deductibles

Understanding the coverage limits and deductibles of a health insurance plan is crucial. Coverage limits refer to the maximum amount the insurance company will pay for a specific medical service or treatment. Deductibles, on the other hand, are the amount you must pay out of pocket before the insurance coverage kicks in.

Look for plans with higher coverage limits, especially for essential services like emergency care, hospitalization, and specialist consultations. Additionally, consider plans with lower deductibles, as this can reduce your out-of-pocket expenses in the event of an unexpected medical situation.

| Plan | Coverage Limit (Annual) | Deductible |

|---|---|---|

| Plan A | $200,000 | $500 |

| Plan B | $300,000 | $1,000 |

| Plan C | $150,000 | $300 |

2. Network of Providers

The network of healthcare providers associated with a health insurance plan is an important consideration. In-network providers are contracted with the insurance company and typically offer discounted rates, ensuring cost-effective healthcare services.

Research the network of providers available under each insurance plan. Look for plans that have a wide network of hospitals, clinics, and specialists in your area or near your university. This ensures that you have convenient access to quality healthcare without incurring additional costs for out-of-network services.

3. Prescription Drug Coverage

Prescription medications can be a significant expense, especially for students with ongoing medical conditions. When evaluating low-cost student health insurance plans, consider the prescription drug coverage offered.

Look for plans that include a comprehensive formulary, covering a wide range of medications. Check if the plan offers generic drug coverage at a discounted rate, as this can significantly reduce your prescription costs. Additionally, inquire about any limitations or restrictions on prescription coverage, such as quantity limits or prior authorization requirements.

4. Mental Health and Wellness Coverage

Student life can be stressful, and maintaining good mental health is essential for overall well-being. When selecting a low-cost student health insurance plan, ensure that it includes adequate coverage for mental health services.

Look for plans that cover therapy sessions, counseling, and psychiatric evaluations. Some plans may also offer additional wellness benefits, such as access to online mental health resources, stress management programs, or discounts on fitness activities. These features can provide valuable support for students facing academic or personal challenges.

5. Preventive Care Coverage

Preventive care is an essential aspect of maintaining good health and can help identify potential health issues early on. When evaluating low-cost student health insurance plans, consider the coverage for preventive services.

Look for plans that cover annual check-ups, immunizations, and screenings for common health conditions. These services can help catch potential health issues before they become more serious and expensive to treat. Additionally, inquire about any wellness programs or incentives offered by the insurance company to encourage students to prioritize their health.

Real-World Examples of Low-Cost Student Health Insurance

To provide a clearer understanding of the options available, let’s explore some real-world examples of low-cost student health insurance plans and their key features:

Example 1: University Health Plan

The University of XYZ offers a comprehensive health plan specifically designed for its students. This plan includes coverage for primary care, specialty consultations, emergency services, and prescription medications. The plan has a low deductible of $250 and offers a wide network of providers, including hospitals and clinics within a 50-mile radius of the university campus.

Additionally, the University Health Plan provides coverage for mental health services, including up to 12 therapy sessions per year. Students can also access online mental health resources and wellness programs through the university's partnership with a leading healthcare provider.

Example 2: Private Insurance Company - Student Advantage Plan

ABC Insurance Company offers a student-specific plan called the Student Advantage Plan. This plan is designed to cater to the unique needs of students, providing coverage for a wide range of medical services. The plan has a coverage limit of 250,000 and a deductible of 750.

The Student Advantage Plan offers a network of providers across the country, ensuring students have access to quality healthcare services regardless of their location. The plan also includes prescription drug coverage, covering both brand-name and generic medications. Students can further benefit from discounts on fitness memberships and wellness programs offered by the insurance company.

Example 3: Government-Sponsored Program - Medicaid

Medicaid is a government-sponsored health insurance program available to eligible individuals in the United States. This program provides comprehensive healthcare coverage, including primary care, specialty services, prescription medications, and mental health services. Medicaid coverage is typically free or has very low premiums, making it an attractive option for students with limited financial means.

To qualify for Medicaid, students must meet certain income and eligibility requirements. The program covers a wide range of services, including preventive care, dental care, and even vision services. Medicaid also offers access to a network of providers, ensuring students can receive quality healthcare services without incurring additional costs.

Tips for Maximizing Your Student Health Insurance Coverage

Once you have secured your low-cost student health insurance plan, there are several strategies you can employ to maximize your coverage and make the most of your benefits:

1. Understand Your Plan’s Benefits

Take the time to thoroughly read and understand the details of your student health insurance plan. Familiarize yourself with the coverage limits, deductibles, and any exclusions or limitations. This knowledge will help you make informed decisions about your healthcare and avoid unexpected expenses.

2. Utilize In-Network Providers

When seeking medical care, prioritize using in-network providers associated with your insurance plan. These providers have agreed to discounted rates, ensuring your out-of-pocket expenses are minimized. Check the insurance company’s website or contact their customer support to verify if a specific provider is in-network.

3. Take Advantage of Preventive Care

Preventive care services are often covered by student health insurance plans, so make sure to utilize them. Schedule regular check-ups, get your immunizations updated, and take advantage of any screenings or wellness programs offered by your insurance provider. Preventive care can help identify potential health issues early on and ensure you stay on top of your overall health.

4. Explore Mental Health Resources

Student life can be stressful, and taking care of your mental health is just as important as physical health. If your insurance plan covers mental health services, make use of them. Seek therapy or counseling sessions if needed, and explore any online resources or support groups offered by your insurance provider or university.

5. Keep Track of Your Expenses

Maintain a record of all your medical expenses, including doctor visits, prescriptions, and any other healthcare-related costs. This will help you stay organized and ensure you are aware of any expenses that may need to be reimbursed by your insurance provider. Keeping track of your expenses can also assist in identifying any billing errors or discrepancies.

Future Implications and Considerations

As a student, it’s important to consider the long-term implications of your health insurance coverage. Here are some key considerations to keep in mind:

1. Continuity of Coverage

As you progress through your academic journey, it’s essential to ensure a smooth transition of your health insurance coverage. If you are planning to study abroad or transition to a new university, research the insurance options available at your new institution or in the host country. Ensure that your current insurance plan provides adequate coverage during this period or consider alternative options to avoid any gaps in coverage.

2. Graduating and Post-Student Life

As you approach graduation, it’s time to start thinking about your health insurance options beyond your student years. Many student health insurance plans have a maximum coverage period, typically up to the age of 26. Research the available insurance options in your region, including employer-sponsored plans or individual market plans. Consider factors such as cost, coverage limits, and any pre-existing condition exclusions when making your decision.

3. Keeping Your Insurance Up to Date

Throughout your time as a student, it’s important to keep your insurance information up to date. Notify your insurance provider of any changes in your personal information, such as a new address or contact details. Additionally, if your health status changes or you develop a new medical condition, inform your insurance provider to ensure your coverage remains accurate and comprehensive.

4. Staying Informed and Educated

The world of health insurance can be complex, and it’s important to stay informed and educated about your rights and options. Stay updated with any changes or developments in the healthcare industry, especially those related to student health insurance. Follow reputable healthcare websites, blogs, or newsletters to stay informed about the latest trends, policies, and best practices.

Conclusion

Securing low-cost student health insurance is a crucial step towards ensuring your well-being and financial stability during your academic journey. By exploring various options, analyzing key factors, and maximizing your coverage, you can find a plan that meets your needs and budget. Remember to stay informed, prioritize your health, and take advantage of the resources available to you.

As you embark on this journey, keep in mind that your health is your greatest asset. With the right student health insurance plan, you can focus on your studies, explore new experiences, and make the most of your time as a student.

How do I know if I’m eligible for government-sponsored health insurance programs like Medicaid?

+Eligibility criteria for government-sponsored health insurance programs vary depending on your country and the specific program. In general, factors such as income, age, and citizenship status are considered. It’s recommended to research the eligibility requirements for the program you’re interested in and consult with the relevant government agencies or healthcare providers for accurate information.

Can I use my student health insurance plan when studying abroad?

+The coverage provided by your student health insurance plan may vary when studying abroad. Some plans offer international coverage, while others may have limitations or require additional policies for overseas travel. It’s crucial to carefully review your plan’s terms and conditions, and consider purchasing supplemental insurance if necessary to ensure adequate coverage during your time abroad.

What happens if I need emergency medical care and my insurance plan has a high deductible?

+If you require emergency medical care and your insurance plan has a high deductible, you may need to pay the full amount of the deductible before the insurance coverage kicks in. However, many emergency services and treatments are considered urgent and may be covered at a reduced rate or with a lower deductible. It’s important to review your plan’s emergency coverage details and understand the financial implications.