Insurance fraud is a serious and pervasive issue that affects the insurance industry and society as a whole. It involves deliberate deception or misrepresentation to obtain unfair advantages or financial benefits from insurance policies. This article aims to delve into the complex world of insurance fraud, exploring its various forms, impacts, and the strategies employed to combat it. By understanding the intricacies of this illegal practice, we can contribute to a safer and more secure insurance environment.

Understanding Insurance Fraud

Insurance fraud encompasses a broad range of illegal activities aimed at deceiving insurance companies and gaining financial gains. These fraudulent acts can occur in various insurance sectors, including health, auto, property, and life insurance. The perpetrators of insurance fraud may include policyholders, third parties, or even insurance professionals themselves.

Common Types of Insurance Fraud

- Claim Fraud: This is one of the most prevalent forms of insurance fraud. It involves making false or exaggerated claims to receive higher compensation than what is legitimately owed. Policyholders may fabricate or exaggerate accidents, injuries, or losses to deceive insurance providers.

- Identity Fraud: Identity theft is a growing concern in the insurance industry. Fraudsters steal personal information, such as social security numbers or driver’s license details, to apply for insurance policies or file claims under false identities.

- Organized Fraud Rings: Sophisticated criminal networks often operate fraud rings, targeting specific insurance sectors. These groups collaborate to stage accidents, manipulate evidence, and submit multiple fraudulent claims.

- Provider Fraud: Unfortunately, insurance professionals can also engage in fraudulent activities. This includes billing for services not rendered, inflating costs, or submitting false claims to insurance companies.

- Premium Evasion: Some policyholders intentionally provide incorrect or misleading information to insurance companies to obtain lower premiums. This can involve misrepresenting their health status, vehicle usage, or property details.

Impact of Insurance Fraud

The consequences of insurance fraud are far-reaching and affect multiple stakeholders:

- Increased Costs for Consumers: Insurance fraud drives up the overall cost of insurance for legitimate policyholders. Insurance companies pass on the financial burden by increasing premiums to compensate for fraudulent claims.

- Undermines Trust: Insurance fraud erodes public trust in the insurance industry. It creates an environment of suspicion and skepticism, making it challenging for insurance companies to establish honest relationships with their clients.

- Resource Drain: Insurance companies invest significant resources in fraud detection and investigation. This diverts funds from other critical areas, such as policyholder support and claim processing.

- Legal and Regulatory Consequences: Perpetrators of insurance fraud face severe legal repercussions, including fines, imprisonment, and civil lawsuits. Insurance companies also face regulatory scrutiny and penalties for non-compliance with fraud detection and prevention measures.

Combating Insurance Fraud

The insurance industry has implemented various strategies and technologies to combat fraud effectively.

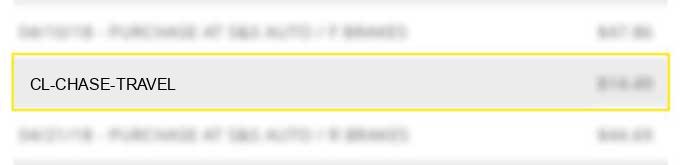

Advanced Analytics and Data Mining

Insurance companies leverage advanced analytics and data mining techniques to identify suspicious patterns and detect potential fraud. By analyzing large datasets, they can identify anomalies, such as multiple claims from the same location or excessive claim frequency.

| Fraud Detection Technique | Description |

|---|---|

| Predictive Modeling | Uses historical data to build models that predict the likelihood of fraud based on specific factors. |

| Anomaly Detection | Identifies unusual patterns or behaviors that deviate from normal claim trends. |

| Link Analysis | Connects and analyzes relationships between entities to identify fraud rings or collusion. |

Enhanced Claims Handling and Investigation

Insurance companies have adopted rigorous claims handling procedures to mitigate fraud risks. They employ trained investigators who thoroughly review and validate claims, cross-checking evidence and seeking expert opinions when necessary.

Collaboration and Information Sharing

The insurance industry recognizes the importance of collaboration to combat fraud effectively. Insurance companies share fraud-related data and intelligence through industry associations and dedicated platforms. This enables them to identify and track fraudsters across multiple insurance sectors.

Public Awareness and Education

Insurance companies actively engage in public awareness campaigns to educate policyholders about the consequences of insurance fraud. By raising awareness, they aim to discourage potential fraudsters and encourage reporting of suspicious activities.

The Future of Insurance Fraud Prevention

As technology advances, so do the tools and strategies to combat insurance fraud. The insurance industry is exploring innovative solutions, such as:

- Artificial Intelligence (AI) and Machine Learning: AI-powered systems can analyze vast amounts of data, identify complex fraud patterns, and automate certain aspects of fraud detection.

- Blockchain Technology: Blockchain offers a secure and transparent way to store and verify insurance-related data, reducing the risk of data manipulation and fraud.

- Biometric Authentication: Implementing biometric technologies, such as facial recognition or fingerprint scanning, can enhance identity verification and prevent identity fraud.

Regulatory and Legal Reforms

Regulatory bodies are also taking steps to strengthen insurance fraud prevention. They are proposing and implementing stricter regulations, increasing penalties for fraudsters, and mandating insurance companies to invest in robust fraud detection systems.

Industry Collaboration and Innovation

Insurance companies are actively collaborating to develop industry-wide fraud prevention standards and best practices. By sharing knowledge and resources, they can stay ahead of evolving fraud tactics and strengthen their collective defense against fraud.

How can I report suspected insurance fraud?

+If you suspect insurance fraud, you should contact your insurance company’s fraud department or the relevant regulatory authority in your jurisdiction. Provide as much detail as possible about the suspected fraudulent activity to aid in the investigation.

What are the legal consequences of insurance fraud?

+Insurance fraud is a serious criminal offense with severe legal consequences. Perpetrators may face fines, imprisonment, or both. Additionally, they may be required to pay restitution to the insurance company and have their insurance coverage terminated.

How can I protect myself from identity fraud in insurance?

+To protect yourself from identity fraud, it’s essential to safeguard your personal information. Avoid sharing sensitive details, such as social security numbers or insurance policy information, with unknown sources. Regularly monitor your credit reports and insurance policies for any suspicious activities.