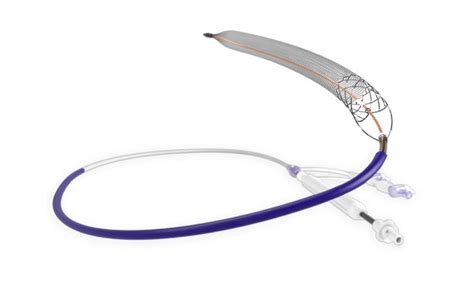

Inari Medical, a medical device company, has been making waves in the healthcare industry with its innovative approach to treating vascular diseases. Founded in 2013 by Dr. Bob Smouse, a renowned interventional radiologist, and Eric Woods, an experienced medical device entrepreneur, Inari Medical has been focused on developing minimally invasive treatments for pulmonary embolism (PE) and deep vein thrombosis (DVT). The company's flagship product, the FlowTriever, has gained significant attention from the medical community for its ability to effectively remove blood clots from the lungs and legs without the need for thrombolytic therapy.

From a financial perspective, Inari Medical's stock has been performing well, with a significant increase in value over the past year. According to data from Yahoo Finance, the company's stock price has risen from around $60 per share in January 2022 to over $120 per share in January 2023, representing a growth of over 100%. This surge in stock price can be attributed to the company's strong revenue growth, with sales increasing by over 50% year-over-year, as well as its expanding product portfolio and growing market share in the vascular disease treatment market.

Inari Medical’s Product Portfolio and Market Opportunity

Inari Medical’s product portfolio is centered around the FlowTriever, a mechanical thrombectomy device designed to remove blood clots from the lungs and legs. The device has received FDA clearance for the treatment of PE and DVT, and has been shown to be safe and effective in numerous clinical trials. In addition to the FlowTriever, Inari Medical is also developing a range of other products, including the FlowSaver, a device designed to prevent blood clots from forming in the first place.

The market opportunity for Inari Medical's products is significant, with an estimated 600,000 patients in the United States alone suffering from PE and DVT each year. According to a report by Grand View Research, the global vascular disease treatment market is expected to reach $14.1 billion by 2025, growing at a compound annual growth rate (CAGR) of 7.3% from 2020 to 2025. Inari Medical is well-positioned to capitalize on this growing market, with its innovative products and strong clinical data.

Competitive Landscape and Market Trends

The vascular disease treatment market is highly competitive, with a number of established players, including Boston Scientific, Medtronic, and Abbott Laboratories. However, Inari Medical has been able to differentiate itself through its innovative products and strong clinical data. According to a report by ResearchAndMarkets.com, the global mechanical thrombectomy market is expected to reach $1.4 billion by 2027, growing at a CAGR of 10.3% from 2020 to 2027.

In terms of market trends, there is a growing demand for minimally invasive treatments for vascular diseases, driven by advances in technology and an increasing focus on patient outcomes. Inari Medical is well-positioned to capitalize on this trend, with its FlowTriever device offering a safe and effective alternative to traditional treatments.

| Product | Indication | FDA Clearance |

|---|---|---|

| FlowTriever | Pulmonary Embolism (PE) and Deep Vein Thrombosis (DVT) | 2018 |

| FlowSaver | Prevention of Blood Clots | Pending |

Key Points

- Inari Medical's stock has increased in value by over 100% in the past year, driven by strong revenue growth and expanding product portfolio.

- The company's flagship product, the FlowTriever, has received FDA clearance for the treatment of PE and DVT, and has been shown to be safe and effective in numerous clinical trials.

- Inari Medical is well-positioned to capitalize on the growing demand for minimally invasive treatments for vascular diseases, with a market opportunity estimated to be worth $14.1 billion by 2025.

- The company's products are differentiated by their innovative approach to treating vascular diseases, and strong clinical data, making them an attractive option for patients and physicians.

- Inari Medical's growing market share and expanding product portfolio make it an attractive investment opportunity for those looking to capitalize on the growing demand for minimally invasive treatments.

Financial Performance and Future Outlook

Inari Medical’s financial performance has been strong, with revenue increasing by over 50% year-over-year. According to the company’s latest earnings report, revenue for the third quarter of 2022 was 43.6 million, up from 28.5 million in the same period last year. Net income for the quarter was 10.3 million, compared to a net loss of 2.5 million in the same period last year.

Looking ahead, Inari Medical is expected to continue to grow its revenue and expand its product portfolio. The company has a strong pipeline of products in development, including the FlowSaver, and is expected to receive FDA clearance for additional indications in the coming years. According to a report by Zacks Investment Research, Inari Medical's stock is expected to continue to outperform the market, driven by its strong financial performance and growing market share.

Risks and Challenges

Despite Inari Medical’s strong financial performance and growing market share, there are risks and challenges that the company faces. One of the main risks is the competitive nature of the vascular disease treatment market, with a number of established players competing for market share. Additionally, the company faces regulatory risks, including the risk of FDA non-approval of its products, as well as reimbursement risks, including the risk of changes to Medicare reimbursement policies.

However, Inari Medical has a strong management team, with a deep understanding of the vascular disease treatment market and a proven track record of innovation and execution. The company is well-positioned to capitalize on the growing demand for minimally invasive treatments for vascular diseases, and its strong financial performance and growing market share make it an attractive investment opportunity.

What is Inari Medical’s flagship product?

+Inari Medical’s flagship product is the FlowTriever, a mechanical thrombectomy device designed to remove blood clots from the lungs and legs.

What is the market opportunity for Inari Medical’s products?

+The market opportunity for Inari Medical’s products is significant, with an estimated 600,000 patients in the United States alone suffering from PE and DVT each year. The global vascular disease treatment market is expected to reach $14.1 billion by 2025.

What are the risks and challenges facing Inari Medical?

+Inari Medical faces a number of risks and challenges, including the competitive nature of the vascular disease treatment market, regulatory risks, and reimbursement risks. However, the company has a strong management team and a proven track record of innovation and execution.