The world of cryptocurrency has experienced tremendous growth and volatility over the past decade, with various digital coins emerging and some becoming household names. As the crypto landscape continues to evolve, navigating it can be challenging, especially for newcomers. Here are five key tips to consider when venturing into the world of cryptocurrency.

Key Points

- Understand the basics of cryptocurrency and blockchain technology to make informed decisions.

- Diversify your crypto portfolio to minimize risk, considering both established and emerging coins.

- Stay updated with the latest news and trends in the crypto market to anticipate potential shifts.

- Implement robust security measures to protect your digital assets from theft and fraud.

- Set clear financial goals and risk tolerance before investing in cryptocurrency to avoid impulsive decisions.

Understanding Cryptocurrency Basics

Before diving into the world of cryptocurrency, it’s essential to have a solid understanding of the underlying technology and concepts. Blockchain technology, which serves as the backbone for most cryptocurrencies, is a decentralized, distributed ledger that records transactions across a network of computers. This technology ensures the security, transparency, and integrity of transactions, making it a crucial aspect of cryptocurrency. Furthermore, understanding the differences between various types of cryptocurrencies, such as proof-of-work versus proof-of-stake, can help in making informed investment decisions.

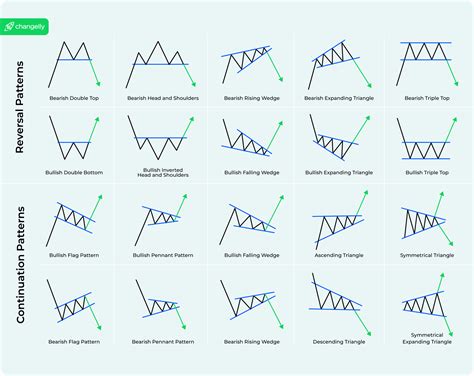

Importance of Diversification

Diversification is a key strategy in any investment portfolio, and it’s equally important in the crypto world. By spreading investments across different types of cryptocurrencies, investors can minimize risk. The crypto market is known for its volatility, with prices fluctuating rapidly. A diversified portfolio can help mitigate potential losses if one particular coin experiences a significant downturn. Consider including a mix of established coins like Bitcoin and Ethereum, which have shown stability over time, alongside emerging coins that may offer higher growth potential but also come with increased risk.

| Cryptocurrency | Market Capitalization | Growth Potential |

|---|---|---|

| Bitcoin (BTC) | $1.2 Trillion | Established, moderate growth |

| Ethereum (ETH) | $500 Billion | High, with potential for smart contract innovation |

| Polkadot (DOT) | $10 Billion | Emerging, high growth potential with interoperability features |

Staying Informed and Securing Assets

The cryptocurrency market is highly dynamic, with news and regulatory changes having immediate impacts on coin prices. Staying informed through reputable sources is crucial for making timely investment decisions. Moreover, the security of digital assets is a significant concern. Implementing robust security measures such as using hardware wallets, enabling two-factor authentication, and being cautious of phishing scams can protect investments from theft and fraud.

Setting Financial Goals and Risk Tolerance

Investing in cryptocurrency should be done with clear financial goals and an understanding of one’s risk tolerance. Given the volatile nature of the crypto market, it’s essential to define what you aim to achieve through your investments, whether it’s long-term growth or short-term gains. Additionally, understanding how much risk you are willing to take on can help in avoiding impulsive decisions based on market fluctuations. Setting a budget and sticking to it, alongside regularly reviewing and adjusting your investment strategy, can help navigate the challenges of the crypto market.

What is the most secure way to store cryptocurrency?

+Hardware wallets are considered the most secure way to store cryptocurrency, as they keep private keys offline, protecting them from hacking and other forms of cyber theft.

How do I start investing in cryptocurrency?

+To start investing in cryptocurrency, begin by choosing a reputable exchange, setting up an account, depositing funds, and then selecting the cryptocurrencies you wish to buy based on your research and investment strategy.

What are the risks associated with investing in cryptocurrency?

+The risks include market volatility, regulatory changes, security risks such as hacking and fraud, and the potential for complete loss of investment. It's crucial to do thorough research and consider these risks before investing.

In conclusion, navigating the world of cryptocurrency requires a combination of knowledge, strategy, and caution. By understanding the basics, diversifying your portfolio, staying informed, securing your assets, and setting clear financial goals, you can better position yourself for success in this dynamic and rapidly evolving market. Remember, the crypto landscape is ever-changing, and what works today may not work tomorrow, making ongoing education and adaptability key to thriving in this space.