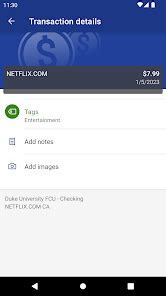

As a member of the Duke Credit Union, you're part of a community that prioritizes financial well-being and mutual support. With a range of services and benefits designed to help you manage your finances effectively, it's essential to make the most out of your membership. In this article, we'll delve into five expert tips tailored specifically for Duke Credit Union members, aiming to enhance your financial literacy, optimize your banking experience, and leverage the unique advantages that come with being part of this credit union.

Key Points

- Understanding and utilizing the credit union's loan options for better financial management

- Leveraging high-yield savings accounts for increased earnings

- Implementing budgeting strategies with the help of financial counseling services

- Enhancing financial security through insurance products offered by the credit union

- Staying informed about financial literacy and community engagement opportunities

Maximizing Loan Options

Duke Credit Union offers a variety of loan options designed to meet the diverse needs of its members, including personal loans, auto loans, and mortgages. Understanding these options and choosing the one that best aligns with your financial goals is crucial. For instance, if you’re looking to consolidate debt, a personal loan with a competitive interest rate could be a viable solution. It’s also worth considering the credit union’s auto loan options, which often come with more favorable terms compared to traditional banks. By carefully reviewing the terms and conditions of each loan type, you can make an informed decision that supports your long-term financial health.

High-Yield Savings Strategies

Savings accounts are a cornerstone of personal finance, and high-yield savings accounts, in particular, offer a way to earn more interest on your deposits. Duke Credit Union’s high-yield savings accounts are designed to help members grow their savings over time. By allocating a portion of your income to these accounts, you can take advantage of the compounded interest, which can significantly increase your savings over the long haul. Additionally, setting up automatic transfers from your checking account to your savings can make saving easier and less prone to being neglected.

| Account Type | Interest Rate | Minimum Balance Requirement |

|---|---|---|

| High-Yield Savings | 2.50% APY | $100 |

| Premium Savings | 3.00% APY | $1,000 |

Financial Counseling and Budgeting

Effective budgeting is the foundation of sound financial management. Duke Credit Union provides its members with access to financial counseling services, which can be incredibly valuable in creating a personalized budget that meets your specific needs and goals. By engaging with these services, you can gain a deeper understanding of your spending habits, identify areas for improvement, and develop strategies to save more efficiently. Moreover, regular budget reviews can help you stay on track and make adjustments as your financial situation evolves.

Insurance Products for Enhanced Security

In addition to banking and loan services, Duke Credit Union offers various insurance products designed to provide members with an added layer of financial security. These products can include life insurance, disability insurance, and even insurance for your loans. By assessing your insurance needs and selecting the products that best fit your situation, you can ensure that you and your loved ones are protected against unforeseen events. It’s also important to review and adjust your insurance coverage periodically to reflect changes in your life and financial circumstances.

Staying Informed and Engaged

Finally, staying informed about financial literacy, community events, and new services offered by the Duke Credit Union is vital for maximizing your membership benefits. The credit union often hosts workshops, webinars, and seminars on topics ranging from budgeting and saving to investing and retirement planning. By participating in these educational opportunities, you can enhance your financial knowledge and make more informed decisions about your money. Additionally, staying connected with the credit union community through newsletters, social media, and local events can provide you with valuable insights and a sense of belonging to a community that shares your financial goals.

What are the benefits of using a credit union over a traditional bank?

+Credit unions, like Duke Credit Union, are member-owned and often offer more favorable rates on loans and deposits, lower fees, and a more personalized service compared to traditional banks.

How can I make the most out of my high-yield savings account?

+To maximize your high-yield savings account, consider setting up automatic transfers from your checking account, avoiding unnecessary withdrawals, and keeping your account balance above the minimum requirement to earn the highest interest rate.

What kinds of insurance products does Duke Credit Union offer, and how can they benefit me?

+Duke Credit Union offers a range of insurance products, including life insurance, disability insurance, and loan insurance. These products can provide financial protection against unexpected events, ensuring that you and your family are secured and that your financial obligations are met even in challenging circumstances.

In conclusion, being a member of the Duke Credit Union comes with a multitude of benefits and opportunities for financial growth. By understanding and leveraging the services and products available, from loan options and high-yield savings accounts to financial counseling and insurance products, you can significantly enhance your financial well-being. Remember, the key to maximizing your membership is to stay informed, engage with the community, and continually seek ways to improve your financial literacy and security.