Collision insurance is an essential aspect of vehicle ownership, offering financial protection in the event of accidents. This guide aims to provide a comprehensive understanding of collision coverage, helping you make informed decisions and navigate the complexities of insurance policies. With the right knowledge, you can ensure your vehicle is adequately protected and understand the process of filing claims should an accident occur.

Whether you're a seasoned driver or a first-time car owner, this guide will empower you with the expertise needed to manage your collision insurance effectively. From policy selection to claim settlement, we'll cover every aspect to ensure you're prepared for any unforeseen circumstances on the road.

Understanding Collision Insurance: A Comprehensive Overview

Collision insurance is a type of coverage within an auto insurance policy that specifically addresses damages caused to your vehicle in an accident. Unlike liability insurance, which covers damages to other parties involved in an accident, collision coverage focuses on the financial protection of your own vehicle. It is designed to provide reimbursement for repairs or replacement costs when your vehicle sustains damage in a collision, regardless of who is at fault.

This type of insurance is particularly crucial for drivers who own newer vehicles or those with substantial financial value. It offers peace of mind, ensuring that even in the event of a costly accident, the policyholder can have their vehicle repaired or replaced without incurring significant out-of-pocket expenses. Collision insurance is often paired with comprehensive insurance, which covers damages from non-collision events such as theft, vandalism, and natural disasters.

The coverage provided by collision insurance is not unlimited and is subject to a deductible, which is the amount you, as the policyholder, agree to pay out of pocket before the insurance coverage kicks in. Deductibles can vary based on the policy and the insurance provider, and choosing a higher deductible can often lead to lower premium costs. It's important to carefully consider the deductible amount when selecting a collision insurance policy to find the right balance between coverage and affordability.

Additionally, collision insurance policies may have specific limitations and exclusions. For instance, wear and tear, mechanical breakdowns, and damages resulting from racing or off-road driving are typically not covered by collision insurance. It's crucial to review the policy documents thoroughly to understand the scope of coverage and any potential limitations or exclusions.

Choosing the Right Collision Insurance: Factors to Consider

Selecting the appropriate collision insurance policy involves careful consideration of several factors. The first step is to evaluate your vehicle's value and determine the extent of coverage you require. For newer vehicles or those with high resale value, comprehensive collision coverage is often a prudent choice. However, for older vehicles that have depreciated significantly, the cost of collision insurance may outweigh the potential benefits, and you might consider opting for liability-only coverage.

Another critical factor to consider is your financial situation and ability to absorb potential losses. Collision insurance policies with higher deductibles can result in lower premiums, but they also require you to pay a larger portion of the repair costs out of pocket. On the other hand, policies with lower deductibles offer more financial protection but come with higher premium costs. Striking the right balance between deductible and premium costs is essential to ensure you have adequate coverage without straining your finances.

Furthermore, it's beneficial to compare quotes from multiple insurance providers to find the best coverage at a competitive price. Shopping around can help you identify the insurance companies that offer the most comprehensive collision insurance policies at affordable rates. Additionally, consider the reputation and financial stability of the insurance provider, as well as their claims handling process and customer service reputation. Choosing a reputable and reliable insurance company can provide added peace of mind and ensure a smoother claims process if an accident occurs.

Key Factors to Evaluate:

- Vehicle Value and Age

- Financial Ability to Cover Deductibles

- Comparison of Quotes from Different Insurers

- Reputation and Reliability of the Insurance Provider

Collision Insurance Coverage: In-Depth Analysis

Collision insurance coverage can vary significantly between different insurance providers and policy types. It's crucial to understand the specific terms and conditions of your policy to ensure you have the protection you need. Here's a detailed breakdown of the key components of collision insurance coverage.

Policy Limits and Deductibles

Policy limits refer to the maximum amount your insurance provider will pay for covered damages. It's essential to choose a policy limit that aligns with the current value of your vehicle. If the policy limit is too low, you might be responsible for paying the difference out of pocket if the repair costs exceed the limit. Conversely, selecting a policy limit that is significantly higher than your vehicle's value may result in unnecessary expenses.

Deductibles, as mentioned earlier, are the amount you pay before your insurance coverage kicks in. A higher deductible means you'll pay less in premiums, but you'll have to contribute more out of pocket when filing a claim. Conversely, a lower deductible offers more financial protection but comes with higher premium costs. It's important to choose a deductible amount that you're comfortable paying should an accident occur.

Coverage Options

Collision insurance policies often offer various coverage options to tailor the policy to your specific needs. These options can include:

- Rental Car Coverage: This option provides reimbursement for rental car expenses while your vehicle is being repaired after an accident covered by your collision insurance.

- Glass Coverage: Some policies include glass coverage, which covers the cost of repairing or replacing windshields, side windows, and sunroofs without applying your deductible.

- Emergency Roadside Assistance: This coverage provides assistance for situations like flat tires, dead batteries, or being locked out of your vehicle.

- Towing and Labor Coverage: This option covers the cost of towing your vehicle to a repair shop and any necessary labor to get your car running again after an accident.

Filing a Collision Insurance Claim: Step-by-Step Guide

In the unfortunate event of an accident, knowing how to navigate the claims process can make a significant difference in the outcome. Here's a step-by-step guide to help you through the process of filing a collision insurance claim.

Step 1: Assess the Damage

After an accident, it's crucial to assess the damage to your vehicle and determine if it's safe to drive. If the vehicle is drivable, carefully move it to a safe location away from traffic. If it's not drivable, turn on your hazard lights and await further instructions from the police or emergency services.

Step 2: Contact Your Insurance Provider

As soon as possible, contact your insurance provider to report the accident. Have your policy number and relevant details about the accident ready. Provide an accurate and detailed account of the incident, including the location, date, and time of the accident, as well as any injuries or property damage involved.

Step 3: Gather Information and Evidence

Collect as much information and evidence as possible at the scene of the accident. This includes taking photos of the damage to your vehicle and any other involved vehicles, as well as documenting the accident scene with photographs or videos. If possible, obtain contact information and insurance details from the other driver(s) involved.

Step 4: Cooperate with the Insurance Adjuster

An insurance adjuster will be assigned to your claim to evaluate the damage and determine the extent of coverage. Cooperate fully with the adjuster, providing all necessary documentation and answering any questions they may have. Be honest and accurate in your communications to ensure a smooth claims process.

Step 5: Obtain Repairs or Replacement

Once the insurance adjuster has assessed the damage and approved the claim, you can proceed with repairing or replacing your vehicle. Choose a reputable repair shop or dealership, and obtain multiple estimates if necessary. Ensure that the repairs are completed to your satisfaction and that all safety standards are met.

Collision Insurance Claims: Common Pitfalls and How to Avoid Them

While collision insurance claims can be straightforward, there are potential pitfalls that drivers should be aware of. By understanding these common issues, you can take proactive steps to avoid them and ensure a smoother claims process.

Underinsured or Overinsured

Choosing the right level of insurance coverage is crucial. Being underinsured means your policy limits are too low to cover the full cost of repairs or replacement, leaving you responsible for the remaining expenses. On the other hand, being overinsured can result in unnecessary premium costs without providing additional benefits. It's important to regularly review and adjust your coverage to ensure it aligns with your vehicle's current value.

Lack of Documentation

Proper documentation is essential for a successful collision insurance claim. This includes having accurate and up-to-date policy documents, as well as detailed records of the accident, including photographs, police reports, and any witness statements. Failing to provide sufficient documentation can delay or even deny your claim, so it's crucial to maintain thorough records.

Not Understanding the Policy

Many drivers fail to thoroughly read and understand their insurance policy, leading to confusion and potential disputes when filing a claim. It's important to familiarize yourself with the terms and conditions of your policy, including any exclusions or limitations. Understanding your policy can help you make informed decisions and avoid unnecessary complications during the claims process.

The Future of Collision Insurance: Trends and Innovations

The world of collision insurance is constantly evolving, with new trends and innovations shaping the industry. As technology advances, insurance providers are incorporating innovative solutions to enhance the claims process and provide better coverage for policyholders.

Telematics and Usage-Based Insurance

Telematics technology, which uses data from vehicle sensors and GPS systems, is gaining traction in the insurance industry. Usage-based insurance policies leverage telematics data to offer personalized insurance rates based on individual driving behavior. This innovative approach allows drivers to save on premiums by demonstrating safe driving habits, while also providing insurers with more accurate risk assessments.

Advanced Claims Handling Technologies

Insurance companies are investing in advanced technologies to streamline the claims process. This includes the use of artificial intelligence (AI) and machine learning algorithms to automate claim assessments and accelerate the settlement process. Additionally, some insurers are exploring the use of virtual reality (VR) and augmented reality (AR) technologies to facilitate remote damage assessments, reducing the need for in-person inspections.

Increased Focus on Preventative Measures

Insurers are increasingly recognizing the benefits of preventative measures in reducing collision risks. This includes offering discounts for drivers who install advanced safety features in their vehicles, such as lane departure warning systems, automatic emergency braking, and adaptive cruise control. By incentivizing the adoption of these technologies, insurers aim to reduce the frequency and severity of accidents, ultimately leading to lower insurance premiums for policyholders.

Collision Insurance FAQ

How does collision insurance differ from comprehensive insurance?

+Collision insurance covers damages to your vehicle caused by a collision with another vehicle or object, while comprehensive insurance covers damages from non-collision events like theft, vandalism, and natural disasters. Collision insurance is often paired with comprehensive insurance to provide comprehensive coverage for your vehicle.

What is a deductible in collision insurance, and how does it work?

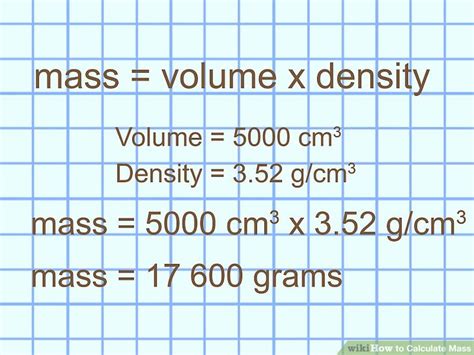

+A deductible is the amount you, as the policyholder, agree to pay out of pocket before your insurance coverage kicks in. For example, if your deductible is 500 and your vehicle sustains 3,000 in damages, you would pay the first 500, and your insurance provider would cover the remaining 2,500.

How can I lower my collision insurance premiums?

+You can potentially lower your collision insurance premiums by choosing a higher deductible, bundling your insurance policies, maintaining a clean driving record, and installing safety features in your vehicle. Additionally, shopping around for quotes from different insurers can help you find competitive rates.

What happens if I’m at fault in an accident, and I have collision insurance?

+If you’re at fault in an accident and have collision insurance, your policy will cover the damages to your vehicle. However, it’s important to note that your insurance rates may increase after an at-fault accident, and you may face additional penalties or legal consequences depending on the severity of the accident.