Being a beneficiary can have a significant impact on one's life, whether it's through inheritance, insurance policies, or other forms of financial support. Understanding the ways to be a beneficiary can help individuals make informed decisions about their financial futures and ensure they are taking full advantage of available benefits. In this article, we will explore five ways to be a beneficiary, including the benefits and considerations of each.

Key Points

- Understanding the different types of beneficiaries, including primary, secondary, and tertiary beneficiaries

- Recognizing the importance of clear and concise beneficiary designations

- Exploring the benefits and considerations of being a beneficiary of a trust

- Learning about the tax implications of being a beneficiary

- Understanding the role of beneficiary designations in estate planning

Understanding Beneficiary Designations

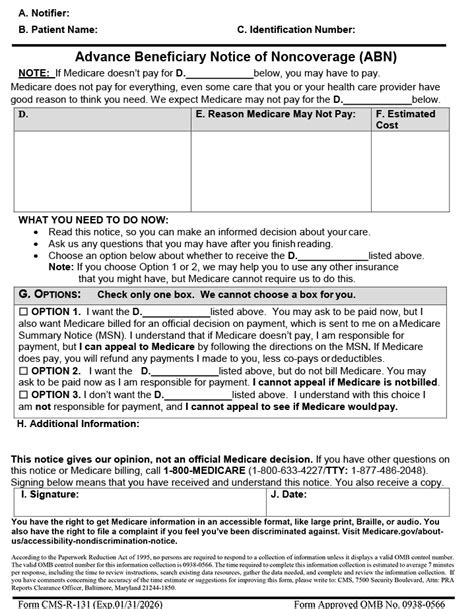

A beneficiary designation is a legal document that outlines who will receive certain assets, such as life insurance policies, retirement accounts, or trusts, upon the death of the account owner. There are several types of beneficiaries, including primary, secondary, and tertiary beneficiaries. Primary beneficiaries are the first in line to receive the assets, while secondary beneficiaries are next in line if the primary beneficiary predeceases the account owner. Tertiary beneficiaries are the last in line to receive the assets.

It's essential to have clear and concise beneficiary designations to avoid confusion and potential disputes. Beneficiary designations should be reviewed and updated regularly to ensure they reflect the account owner's current wishes and circumstances. Failure to update beneficiary designations can lead to unintended consequences, such as assets being distributed to the wrong person or being subject to unnecessary taxes.

Benefits of Being a Beneficiary

Being a beneficiary can provide financial security and support, especially during difficult times. Beneficiaries can receive tax-free benefits, such as life insurance proceeds, which can help cover funeral expenses, outstanding debts, and other financial obligations. Additionally, beneficiaries may be eligible to receive benefits from trusts, which can provide a steady income stream and help support their financial well-being.

However, being a beneficiary also comes with responsibilities and potential tax implications. Beneficiaries may be required to report income from inherited assets on their tax returns, which can impact their tax liability. Furthermore, beneficiaries may be subject to estate taxes, depending on the value of the inherited assets and the applicable tax laws.

| Type of Beneficiary | Description |

|---|---|

| Primary Beneficiary | First in line to receive assets |

| Secondary Beneficiary | Next in line to receive assets if primary beneficiary predeceases account owner |

| Tertiary Beneficiary | Last in line to receive assets |

Being a Beneficiary of a Trust

A trust is a legal arrangement where assets are held and managed by a trustee for the benefit of one or more beneficiaries. Being a beneficiary of a trust can provide financial support and security, as well as potential tax benefits. However, it’s essential to understand the terms and conditions of the trust, including the beneficiary’s rights and responsibilities.

Trusts can be complex and nuanced, and beneficiaries should seek professional advice to ensure they understand their role and obligations. Trust beneficiaries may be subject to trust administration fees, which can impact the value of the benefits they receive. Additionally, trust beneficiaries may be required to report income from the trust on their tax returns, which can impact their tax liability.

Tax Implications of Being a Beneficiary

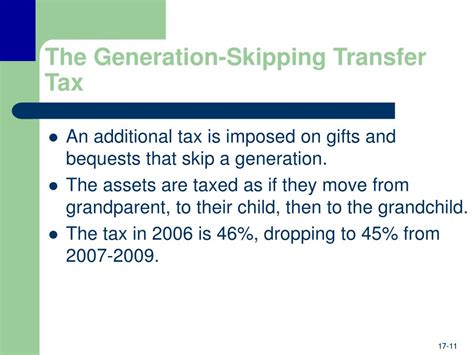

Being a beneficiary can have tax implications, depending on the type of assets inherited and the applicable tax laws. Inherited assets may be subject to income taxes, which can impact the beneficiary’s tax liability. Additionally, beneficiaries may be subject to estate taxes, depending on the value of the inherited assets and the applicable tax laws.

It's essential for beneficiaries to seek professional advice to ensure they understand their tax obligations and potential liabilities. Beneficiaries may be able to minimize tax liabilities by taking advantage of tax deductions and credits, such as the charitable deduction or the mortgage interest deduction.

What is a beneficiary designation?

+A beneficiary designation is a legal document that outlines who will receive certain assets, such as life insurance policies, retirement accounts, or trusts, upon the death of the account owner.

What are the benefits of being a beneficiary?

+Being a beneficiary can provide financial security and support, especially during difficult times. Beneficiaries can receive tax-free benefits, such as life insurance proceeds, which can help cover funeral expenses, outstanding debts, and other financial obligations.

What are the tax implications of being a beneficiary?

+Being a beneficiary can have tax implications, depending on the type of assets inherited and the applicable tax laws. Inherited assets may be subject to income taxes, which can impact the beneficiary's tax liability. Additionally, beneficiaries may be subject to estate taxes, depending on the value of the inherited assets and the applicable tax laws.

In conclusion, being a beneficiary can have a significant impact on one’s life, providing financial security and support. However, it’s essential to understand the benefits and considerations of being a beneficiary, including the importance of clear and concise beneficiary designations, the potential tax implications, and the role of beneficiary designations in estate planning. By seeking professional advice and carefully reviewing beneficiary designations, individuals can ensure they are taking full advantage of available benefits and avoiding potential disputes.