The Uniform Income and Cash Expenses (UIC) earning statement is a crucial tool for businesses and individuals to track their financial performance over a specific period. It provides a comprehensive overview of the revenues, expenses, and profits, enabling informed decision-making and strategic planning. In this guide, we will delve into the intricacies of the UIC earning statement, exploring its components, preparation, and analysis, as well as its significance in the financial reporting landscape.

Understanding the UIC Earning Statement Components

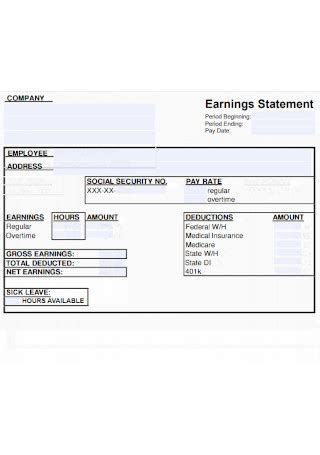

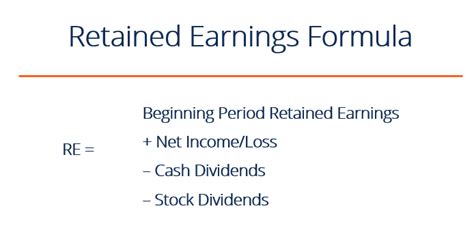

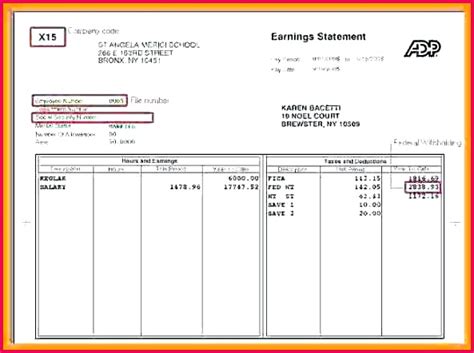

A UIC earning statement typically consists of three primary sections: revenues, expenses, and net income. The revenue section encompasses all income generated from the company’s core operations, including sales, services, and other sources. The expenses section, on the other hand, includes all costs incurred during the period, such as labor, materials, overheads, and other expenditures. The net income, calculated by subtracting total expenses from total revenues, represents the company’s profitability.

Revenue Recognition and Measurement

Revenue recognition is a critical aspect of the UIC earning statement, as it directly impacts the company’s financial performance. According to the Generally Accepted Accounting Principles (GAAP), revenue should be recognized when it is earned, regardless of when the payment is received. This principle ensures that revenue is matched with the corresponding expenses, providing a accurate picture of the company’s financial position. For instance, a company that recognizes revenue upon delivery of goods or services must ensure that the revenue is earned and realization is probable.

| Revenue Category | Recognition Criteria |

|---|---|

| Sales Revenue | Delivery of goods or services |

| Service Revenue | Completion of service |

| Other Revenue | Receipt of payment or other triggering event |

Preparing the UIC Earning Statement

The preparation of the UIC earning statement involves several steps, including data collection, classification, and analysis. The process begins with the gathering of financial data from various sources, such as sales invoices, payroll records, and expense accounts. The data is then classified into the respective revenue and expense categories, ensuring that all transactions are properly accounted for. Finally, the data is analyzed to identify trends, patterns, and areas for improvement, providing valuable insights for strategic decision-making.

Expenses Classification and Measurement

Expenses classification is another crucial aspect of the UIC earning statement, as it enables the company to identify areas where costs can be optimized. The expenses can be classified into different categories, such as labor, materials, overheads, and other expenditures. The measurement of expenses involves the assignment of costs to specific activities or departments, ensuring that the costs are properly matched with the corresponding revenues. For example, a company that incurs significant labor costs may need to analyze its labor expenses to identify areas for cost reduction.

Key Points

- The UIC earning statement provides a comprehensive overview of a company's financial performance.

- Revenue recognition is a critical aspect of the UIC earning statement, as it directly impacts the company's financial position.

- Expenses classification and measurement are essential for identifying areas where costs can be optimized.

- The UIC earning statement is prepared by gathering financial data, classifying and analyzing the data, and identifying trends and patterns.

- The statement is used for strategic decision-making, financial planning, and performance evaluation.

Analyzing the UIC Earning Statement

The analysis of the UIC earning statement involves the examination of various financial metrics, such as revenue growth, expense ratios, and net income margins. The analysis enables the company to identify areas of strength and weakness, providing valuable insights for strategic decision-making. For instance, a company that experiences significant revenue growth may need to analyze its expense structure to ensure that costs are properly managed.

Financial Metrics and Ratios

Financial metrics and ratios are essential tools for analyzing the UIC earning statement. The metrics include revenue growth rate, expense ratio, net income margin, and return on investment (ROI). The ratios provide a framework for evaluating the company’s financial performance, enabling the identification of trends, patterns, and areas for improvement. For example, a company that experiences a decline in net income margin may need to analyze its expense structure to identify areas for cost reduction.

| Financial Metric | Calculation |

|---|---|

| Revenue Growth Rate | (Current Year Revenue - Previous Year Revenue) / Previous Year Revenue |

| Expense Ratio | Total Expenses / Total Revenues |

| Net Income Margin | Net Income / Total Revenues |

| Return on Investment (ROI) | Net Income / Total Assets |

What is the primary purpose of the UIC earning statement?

+The primary purpose of the UIC earning statement is to provide a comprehensive overview of a company's financial performance over a specific period, enabling informed decision-making and strategic planning.

How is revenue recognition determined in the UIC earning statement?

+Revenue recognition is determined in accordance with the Generally Accepted Accounting Principles (GAAP), which requires that revenue be recognized when it is earned, regardless of when the payment is received.

What are the key components of the UIC earning statement?

+The key components of the UIC earning statement include revenues, expenses, and net income, which provide a comprehensive overview of a company's financial performance.

Meta Description: Learn how to prepare and analyze the Uniform Income and Cash Expenses (UIC) earning statement, a crucial tool for businesses and individuals to track their financial performance and make informed decisions.