Texas, known for its thriving economy and diverse workforce, has specific laws governing wages and employment. For both employers and employees, understanding these laws is crucial for ensuring fair compensation and compliance with state and federal regulations. The Texas wage calculator is a tool designed to help individuals calculate their wages, considering factors such as hourly rate, number of hours worked, and deductions. However, the complexity of wage calculation, especially when factoring in overtime, deductions, and different types of employment, necessitates a comprehensive approach beyond just a calculator.

Understanding Texas Wage Laws

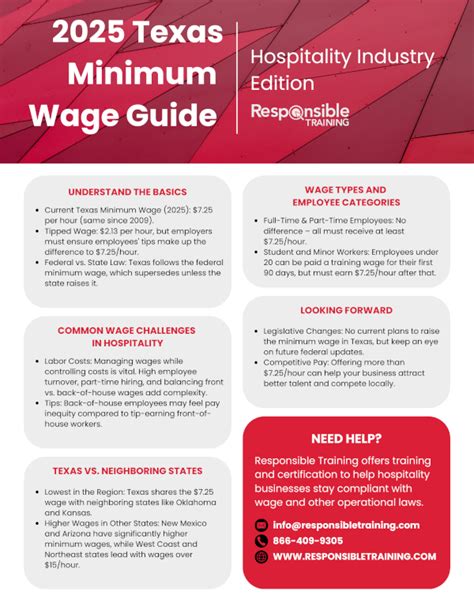

Texas wage laws are designed to protect employees by setting a minimum standard for wages and working conditions. The minimum wage in Texas, as of the last update, is $7.25 per hour, aligning with the federal minimum wage. However, for employees who receive tips, the minimum wage can be lower, as tips are expected to make up the difference. Employers must ensure that the combination of the lower minimum wage and tips equals or exceeds the standard minimum wage. Understanding these nuances is essential for accurately calculating wages.

Overtime Pay in Texas

Overtime pay is another critical aspect of Texas wage laws. Generally, employees who work more than 40 hours in a workweek are entitled to overtime pay, which is at least 1.5 times their regular rate of pay. The calculation of overtime pay can become complex, especially for employees with variable rates of pay or those who work irregular schedules. The Texas wage calculator can help simplify this process, but it’s also important to understand the underlying laws and regulations that dictate overtime pay.

| Employment Type | Minimum Wage | Overtime Eligibility |

|---|---|---|

| Non-Exempt Employees | $7.25/hour | Eligible for overtime pay after 40 hours/week |

| Tipped Employees | $2.13/hour (tips must bring wage to $7.25/hour) | Eligible for overtime pay after 40 hours/week |

| Exempt Employees | Varies (must meet specific criteria) | Not eligible for overtime pay |

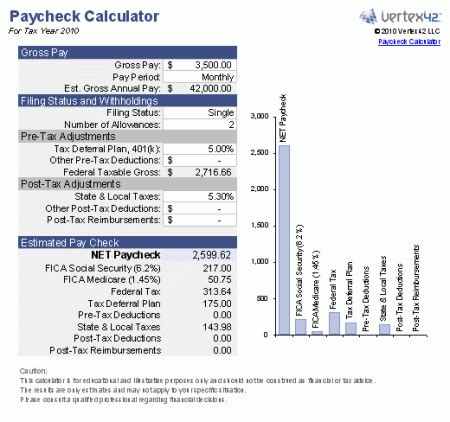

Using a Texas Wage Calculator

A Texas wage calculator is a valuable tool for employers and employees alike. It can help calculate gross pay, net pay, and even deductions for taxes and other benefits. When using a Texas wage calculator, it’s essential to input accurate information, including the employee’s hourly rate, number of hours worked, and any deductions. The calculator can then provide a precise calculation of wages, including overtime pay, if applicable.

Considerations for Employers

Employers must ensure that they are using the wage calculator correctly and that they understand the legal implications of wage calculation. This includes being aware of the minimum wage, overtime laws, and any specific regulations that apply to their industry or type of employees. Moreover, employers should maintain accurate records of employee hours and wages, as audits and disputes can arise.

Key Points

- Understand the minimum wage and overtime laws in Texas.

- Correctly classify employees as exempt or non-exempt for overtime purposes.

- Use a Texas wage calculator to simplify wage calculations.

- Maintain accurate and detailed records of employee hours and wages.

- Stay informed about updates to labor laws and regulations that may affect wage calculation and employment practices.

In conclusion, while a Texas wage calculator can be a powerful tool for calculating wages, it's part of a broader landscape of employment law and practice. Both employers and employees must have a deep understanding of the underlying laws and regulations to ensure compliance and fairness. By combining the use of a wage calculator with a comprehensive knowledge of Texas wage laws, individuals can navigate the complexities of wage calculation with confidence.

What is the current minimum wage in Texas?

+The current minimum wage in Texas is 7.25 per hour, which is the same as the federal minimum wage. For tipped employees, the minimum wage can be lower, provided that tips bring the wage up to 7.25 per hour.

How do I calculate overtime pay in Texas?

+Overtime pay in Texas is calculated at 1.5 times the employee’s regular rate of pay for hours worked beyond 40 in a workweek. For example, if an employee’s regular rate is 10 per hour, their overtime rate would be 15 per hour.

What types of employees are exempt from overtime pay in Texas?

+Exempt employees, such as those in executive, administrative, or professional roles, are not entitled to overtime pay. However, their employment must meet specific criteria outlined by the FLSA and Texas state laws to be considered exempt.