When traveling in the United States, many individuals opt for the convenience and flexibility of renting a vehicle. However, navigating the intricacies of rental vehicle insurance can be a daunting task, filled with complex terminology and fine print. This comprehensive guide aims to demystify the world of rental car insurance in the USA, ensuring you make informed decisions and understand your coverage options.

Understanding Rental Car Insurance Basics

Rental car insurance is a vital component of your travel plans, providing protection against potential accidents, theft, or damage while operating a rental vehicle. In the USA, several types of insurance coverage are available, each serving a unique purpose.

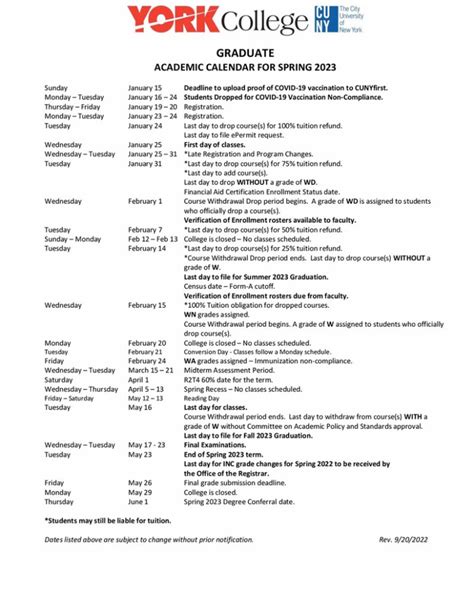

Collision Damage Waiver (CDW)

A Collision Damage Waiver, often referred to as a Loss Damage Waiver (LDW), is a form of insurance offered by rental car companies. It waives your financial responsibility for damage to the rental car, provided the damage is not due to gross negligence or specific exclusions in the rental agreement. CDW/LDW policies vary between rental companies, so it’s crucial to read the fine print.

| Rental Company | CDW/LDW Coverage |

|---|---|

| Company A | Covers damage to the rental car, with a deductible of $1,000. |

| Company B | Includes comprehensive coverage with no deductible, but excludes damage from off-road driving. |

| Company C | Waives all financial responsibility for damage, including theft, with a $500 excess. |

Liability Insurance

Liability insurance is a legal requirement in most states and covers the cost of damage or injury you cause to others while driving the rental car. This insurance protects you from claims made by third parties, such as other drivers or pedestrians.

Each state has its own minimum liability coverage requirements. For instance, California requires a minimum of $15,000 for bodily injury per person, $30,000 for bodily injury per accident, and $5,000 for property damage. However, experts recommend purchasing higher liability limits to ensure adequate protection.

Personal Accident Insurance (PAI) and Personal Effects Coverage (PEC)

Personal Accident Insurance provides coverage for medical expenses and accidental death or dismemberment for the driver and passengers of the rental vehicle. Personal Effects Coverage, on the other hand, insures personal belongings left in the rental car against theft or damage.

While these coverages can provide peace of mind, they are often not necessary if you have adequate health and homeowners or renters insurance.

The Impact of Credit Card Benefits

Many credit cards offer rental car insurance benefits as a cardholder perk. These benefits can include CDW/LDW coverage, liability insurance, and even personal accident insurance. However, it’s essential to understand the limitations and exclusions of these benefits.

For instance, some credit cards only provide coverage if the rental is booked using the card. Others may have restrictions on the type of vehicle eligible for coverage or have geographical limitations. Always read the fine print and consider contacting your credit card issuer for clarification.

Assessing Your Insurance Needs

When deciding on rental car insurance, it’s crucial to assess your specific needs and existing insurance coverage.

Personal Auto Insurance

If you have a personal auto insurance policy, it may extend to rental vehicles. Check your policy to understand the extent of your coverage. Many policies include collision and comprehensive coverage, which can cover damage to the rental car. However, it’s important to note that these policies often have deductibles and may not cover rental cars of a certain value.

Additionally, personal auto insurance typically does not cover liability when driving a rental car. You may need to purchase supplemental liability insurance from the rental company to meet local requirements.

Travel Insurance

Travel insurance policies often include rental car coverage as part of their package. These policies can provide comprehensive protection, covering collision damage, theft, and liability. Some travel insurance plans also include personal accident insurance and personal effects coverage.

Consider purchasing travel insurance if you plan to rent a car during your trip. These policies can provide added peace of mind and often offer 24/7 emergency assistance.

Rental Company’s Insurance Policies

Rental car companies offer various insurance options, including CDW/LDW, liability insurance, and personal accident insurance. It’s essential to compare these policies and their costs to determine the best value for your needs.

Some rental companies offer packages that bundle multiple insurance types, providing a more comprehensive coverage option. However, always review the terms and conditions to ensure you understand what is and isn't covered.

Best Practices for Rental Car Insurance

To ensure a smooth and stress-free rental car experience, consider the following best practices:

- Review your existing insurance policies, including auto, home, and travel insurance, to understand your coverage.

- Check the rental car company's insurance policies and compare them to your needs and existing coverage.

- Consider purchasing supplemental insurance if your existing policies have gaps or if you require additional peace of mind.

- Read the fine print of all insurance policies and rental agreements to understand exclusions and limitations.

- Document any damage to the rental car upon pickup and report any incidents during the rental period promptly.

Conclusion

Rental car insurance in the USA is a complex but necessary aspect of your travel plans. By understanding the different types of coverage and assessing your specific needs, you can make informed decisions and protect yourself and your finances while on the road. Always read the fine print, compare policies, and don’t hesitate to seek clarification from insurance providers or rental car companies.

Can I decline the rental car company’s insurance if I have my own auto insurance?

+

Yes, you can decline the rental car company’s insurance if your personal auto insurance policy extends to rental vehicles. However, it’s crucial to review your policy and understand the extent of your coverage. Some policies may have limitations or deductibles that could leave you financially responsible in certain situations.

What happens if I cause an accident while driving a rental car without liability insurance?

+

If you cause an accident while driving a rental car without liability insurance, you may be held financially responsible for any damage or injury caused. This could result in significant out-of-pocket expenses, so it’s crucial to ensure you have adequate liability coverage.

Are there any states that do not require liability insurance for rental cars?

+

While liability insurance is generally required across the USA, there may be variations in specific states. It’s essential to check the requirements of the state you’re renting in. However, it’s recommended to have liability insurance regardless of state requirements to protect yourself financially.