When it comes to understanding the nuances of property law, it's essential to distinguish between real property and personal property. This fundamental distinction has significant implications for property owners, buyers, and sellers, as it affects the way properties are bought, sold, and transferred. In this article, we'll delve into the differences between real property and personal property, exploring the characteristics, implications, and practical applications of each.

Key Points

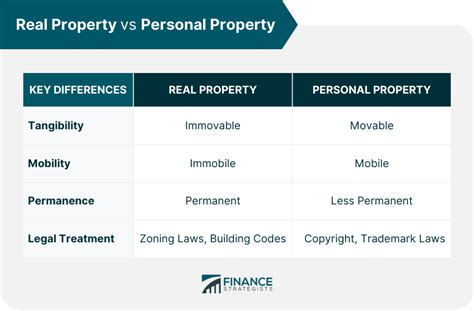

- Real property refers to land and immovable structures, while personal property encompasses movable assets.

- The distinction between real and personal property affects property ownership, transfer, and taxation.

- Real property is typically subject to local and state regulations, whereas personal property is often governed by federal laws.

- Understanding the differences between real and personal property is crucial for navigating property transactions, estate planning, and tax obligations.

- Both real and personal property can be used as collateral for loans, but the process and requirements differ significantly.

Real Property: Definition and Characteristics

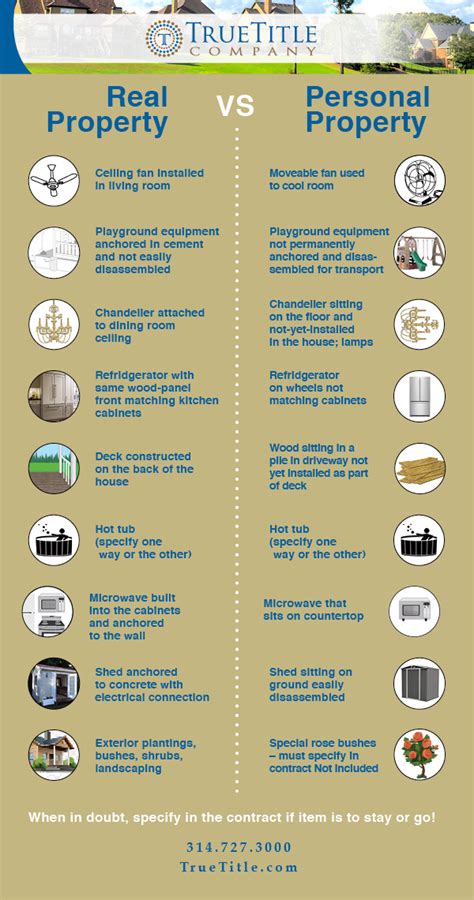

Real property, also known as real estate, refers to land and any permanent structures attached to it, such as buildings, bridges, and roads. This type of property is considered immovable, meaning it cannot be easily relocated or transferred. Real property includes:

- Land, including vacant lots and undeveloped parcels

- Buildings, such as residential homes, commercial properties, and industrial facilities

- Structures, like bridges, dams, and pipelines

- Mineral rights and other subsurface interests

Real property is often subject to local and state regulations, such as zoning laws, building codes, and environmental regulations. The ownership and transfer of real property are typically recorded in public records, providing a clear chain of title and facilitating the buying and selling process.

Types of Real Property Interests

There are several types of real property interests, including:

- Fee simple absolute: The most common type of real property interest, which grants the owner complete control and ownership of the property.

- Leasehold interest: A temporary interest in real property, where the owner has the right to use the property for a specified period.

- Easement: A non-possessory interest in real property, which grants the owner the right to use someone else’s property for a specific purpose.

Understanding the different types of real property interests is essential for navigating property transactions, as each type of interest has its own set of rights and responsibilities.

Personal Property: Definition and Characteristics

Personal property, also known as chattels, refers to movable assets that are not attached to the land. This type of property can be easily relocated or transferred, and includes:

- Tangible personal property, such as:

- Vehicles, including cars, trucks, and boats

- Furniture and appliances

- Jewelry and other precious items

- Intangible personal property, such as:

- Stocks and bonds

- Intellectual property, including patents, trademarks, and copyrights

- Bank accounts and other financial assets

Personal property is often governed by federal laws, such as the Uniform Commercial Code (UCC), which provides a framework for buying, selling, and transferring personal property.

Types of Personal Property Interests

There are several types of personal property interests, including:

- Ownership interest: The most common type of personal property interest, which grants the owner complete control and ownership of the property.

- Security interest: A type of interest that grants the owner the right to use the property as collateral for a loan or other obligation.

- Leasehold interest: A type of interest that grants the owner the right to use someone else’s personal property for a specified period.

Understanding the different types of personal property interests is essential for navigating property transactions, as each type of interest has its own set of rights and responsibilities.

| Category | Real Property | Personal Property |

|---|---|---|

| Type of Interest | Fee simple absolute, leasehold interest, easement | Ownership interest, security interest, leasehold interest |

| Governing Laws | Local and state regulations | Federal laws, such as the UCC |

| Transfer Process | Recorded in public records | Typically involves a bill of sale or other written agreement |

Practical Applications and Implications

The distinction between real and personal property has significant practical applications and implications, including:

- Taxation: Real property is typically subject to property taxes, while personal property is often subject to sales taxes or other types of taxes.

- Transfer Process: The transfer process for real property typically involves recording the transaction in public records, while personal property transactions often involve a bill of sale or other written agreement.

- Collateralization: Both real and personal property can be used as collateral for loans, but the process and requirements differ significantly.

Understanding the practical applications and implications of real and personal property is essential for navigating property transactions, estate planning, and tax obligations.

What is the main difference between real and personal property?

+The main difference between real and personal property is that real property refers to land and immovable structures, while personal property encompasses movable assets.

How are real and personal property taxed?

+Real property is typically subject to property taxes, while personal property is often subject to sales taxes or other types of taxes.

Can personal property be used as collateral for a loan?

+Yes, personal property can be used as collateral for a loan, but the process and requirements differ significantly from using real property as collateral.

In conclusion, understanding the distinction between real and personal property is essential for navigating property transactions, estate planning, and tax obligations. By recognizing the characteristics, implications, and practical applications of each type of property, individuals can make informed decisions and avoid potential pitfalls. Whether you’re a seasoned property owner or a first-time buyer, it’s crucial to appreciate the nuances of real and personal property to ensure a successful and stress-free transaction.