Quote Insurance, a revolutionary concept in the insurance industry, is transforming the way individuals and businesses secure their financial protection. This innovative approach offers a seamless and personalized experience, empowering users to take control of their insurance needs with precision and efficiency. In this comprehensive exploration, we delve into the intricacies of Quote Insurance, uncovering its mechanics, benefits, and the transformative impact it has on the traditional insurance landscape.

The Evolution of Insurance: Introducing Quote Insurance

In an era defined by technological advancements and evolving consumer expectations, the insurance industry has witnessed a paradigm shift. Quote Insurance emerges as a beacon of progress, challenging the conventional norms and reshaping the insurance experience.

At its core, Quote Insurance is an online platform that utilizes advanced algorithms and data analytics to provide precise and tailored insurance quotes. It revolutionizes the traditional insurance quote process, which often involves lengthy forms, tedious paperwork, and multiple phone calls. With Quote Insurance, the entire process is streamlined, offering a user-friendly interface that guides individuals through a personalized journey to find the perfect insurance coverage.

How Quote Insurance Works

The process begins with a simple online form, where users input their basic information and the type of insurance they seek. Whether it’s auto, home, health, or business insurance, Quote Insurance’s platform is versatile and comprehensive.

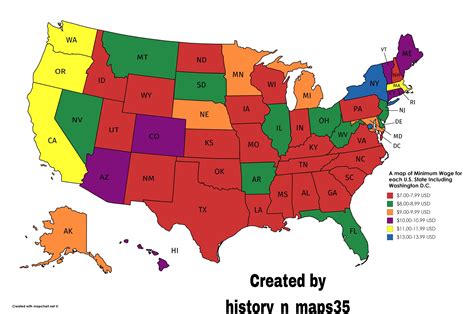

Behind the scenes, Quote Insurance’s proprietary algorithms analyze a vast array of data points. These include not only the user’s specific needs and preferences but also external factors such as geographical location, industry trends, and historical data. This data-driven approach ensures that the quotes generated are not only accurate but also highly competitive.

Once the initial information is provided, users are presented with a range of insurance options tailored to their unique circumstances. Each quote is accompanied by a detailed breakdown, explaining the coverage, exclusions, and any additional benefits or add-ons available. This level of transparency empowers users to make informed decisions, ensuring they select the policy that best aligns with their needs and budget.

Benefits of Quote Insurance

- Time Efficiency: Quote Insurance eliminates the need for extensive research and multiple quote comparisons. Within minutes, users can obtain multiple quotes, saving them valuable time and effort.

- Personalized Experience: By considering individual needs and preferences, Quote Insurance provides a highly personalized experience. This ensures that users receive quotes tailored to their specific circumstances, making the insurance selection process more efficient and accurate.

- Cost-Effectiveness: The competitive nature of Quote Insurance’s platform often leads to more affordable insurance options. By aggregating quotes from multiple providers, users can easily compare prices and find the best value for their money.

- Convenience: Accessible from any internet-enabled device, Quote Insurance offers unparalleled convenience. Users can obtain quotes and manage their insurance needs anytime, anywhere, without the constraints of traditional office hours.

- Data-Driven Decisions: The use of advanced algorithms and data analytics ensures that Quote Insurance’s quotes are based on accurate and up-to-date information. This reduces the risk of errors and provides users with reliable and trustworthy insurance options.

Case Studies: Real-World Impact of Quote Insurance

To truly understand the transformative power of Quote Insurance, let’s explore some real-world examples:

Auto Insurance Revolution

John, a busy professional, needed to renew his auto insurance but had limited time to research and compare quotes. With Quote Insurance, he was able to obtain multiple competitive quotes within minutes. The platform’s user-friendly interface guided him through the process, and he was impressed by the detailed explanations of each policy’s coverage and benefits. John not only saved time but also found a policy that offered better coverage at a lower price than his previous provider.

Home Insurance Simplified

Sarah, a first-time homeowner, was overwhelmed by the complexity of home insurance. With Quote Insurance, she discovered a simplified and transparent process. The platform’s intuitive design helped her understand the various aspects of home insurance, and she was able to secure a comprehensive policy that provided peace of mind. Sarah appreciated the platform’s ability to explain the fine print, ensuring she made an informed decision.

Business Insurance Made Easy

Small business owner, David, was seeking affordable and comprehensive business insurance. Quote Insurance’s platform offered a range of options tailored to his industry and specific business needs. The platform’s data-driven approach provided him with accurate quotes, allowing him to compare and select the best coverage for his business. David was impressed by the platform’s efficiency and the time it saved him, enabling him to focus on growing his business.

Performance Analysis and Future Prospects

Quote Insurance’s performance has been remarkable, with a steady increase in user adoption and satisfaction. The platform’s success can be attributed to its ability to address common pain points in the insurance industry:

- Simplified Process: Quote Insurance streamlines the insurance quote process, making it accessible and user-friendly for individuals and businesses.

- Transparency: By providing detailed breakdowns of quotes, the platform promotes transparency and empowers users to make confident decisions.

- Data-Driven Accuracy: The use of advanced algorithms ensures accurate and reliable quotes, building trust among users.

- Competitive Pricing: By aggregating quotes from multiple providers, Quote Insurance often leads to more affordable insurance options, benefiting users financially.

Looking ahead, Quote Insurance's future prospects are promising. As technology continues to advance and consumer expectations evolve, the platform is well-positioned to adapt and innovate. Potential areas of growth include:

- Expanded Coverage Options: Quote Insurance can further expand its range of insurance products, catering to a broader spectrum of user needs.

- Enhanced Personalization: By leveraging machine learning, the platform can offer even more personalized recommendations, ensuring users receive the most suitable insurance solutions.

- Integration with Emerging Technologies: Exploring partnerships with fintech and insurtech companies can open doors to innovative payment options and insurance-related services.

- Global Expansion: With a proven track record, Quote Insurance has the potential to expand its operations globally, bringing its transformative insurance experience to a wider audience.

Conclusion: Empowering Users, Revolutionizing Insurance

Quote Insurance represents a significant milestone in the evolution of the insurance industry. By leveraging technology and data analytics, it has created a seamless and personalized insurance experience. The platform's success lies in its ability to empower users, providing them with the tools to make informed decisions and secure the insurance coverage they need.

As Quote Insurance continues to thrive and innovate, it is poised to shape the future of insurance, making it more accessible, efficient, and tailored to the unique needs of individuals and businesses. The impact of this revolutionary concept extends beyond convenience, offering a glimpse into a future where insurance is not just a necessity but a strategic and beneficial aspect of financial planning.

Frequently Asked Questions

How accurate are the quotes provided by Quote Insurance?

+Quote Insurance’s quotes are highly accurate due to its advanced algorithms and data analytics. The platform considers a wide range of factors, ensuring that the quotes generated are precise and tailored to individual needs. Users can trust that the quotes they receive are reliable and based on the most up-to-date information.

Can I compare quotes from different providers on Quote Insurance’s platform?

+Absolutely! One of the key advantages of Quote Insurance is its ability to aggregate quotes from multiple insurance providers. Users can easily compare quotes side by side, making it convenient to find the best coverage at the most competitive price.

Is my personal information secure on Quote Insurance’s platform?

+Yes, Quote Insurance prioritizes data security and privacy. The platform utilizes advanced encryption technologies to protect user information. Additionally, Quote Insurance adheres to strict data protection regulations, ensuring that user data is handled with the utmost care and confidentiality.

Can I get a quote for specialized insurance, such as cyber liability or pet insurance?

+Quote Insurance’s platform offers a wide range of insurance options, including specialized coverage. Whether you’re seeking cyber liability insurance, pet insurance, or any other unique insurance need, Quote Insurance strives to provide quotes for a comprehensive array of policies.

How does Quote Insurance ensure the quality of insurance providers listed on its platform?

+Quote Insurance carefully curates a list of reputable insurance providers. The platform conducts thorough background checks and assesses the financial stability and customer satisfaction ratings of each provider. By partnering with trusted insurance companies, Quote Insurance ensures that users have access to high-quality insurance options.