Welcome to the ultimate guide to pet health care insurance, a comprehensive resource designed to empower pet owners with the knowledge and insights needed to make informed decisions about their furry friends' health and well-being. In today's world, where pets are cherished family members, ensuring their long-term health and happiness is a top priority. This article will delve into the intricacies of pet health care insurance, exploring its benefits, coverage options, and how it can provide peace of mind for pet owners.

Understanding Pet Health Care Insurance: A Necessity for Pet Parents

As veterinary medicine advances and pet owners become increasingly aware of the various health issues their companions may face, the importance of pet health care insurance has grown exponentially. Much like human health insurance, pet insurance offers financial protection and access to advanced medical care for our beloved animals. With the rising costs of veterinary treatments and the potential for unexpected illnesses or injuries, pet insurance serves as a safety net, ensuring that pet owners can provide the best possible care without financial strain.

The concept of pet insurance has evolved significantly over the years, with a wide range of coverage options now available to suit different pet needs and owner preferences. From comprehensive plans that cover a broad spectrum of illnesses and accidents to more tailored policies focusing on specific conditions, pet owners have the flexibility to choose the right coverage for their pets.

The Benefits of Pet Health Care Insurance

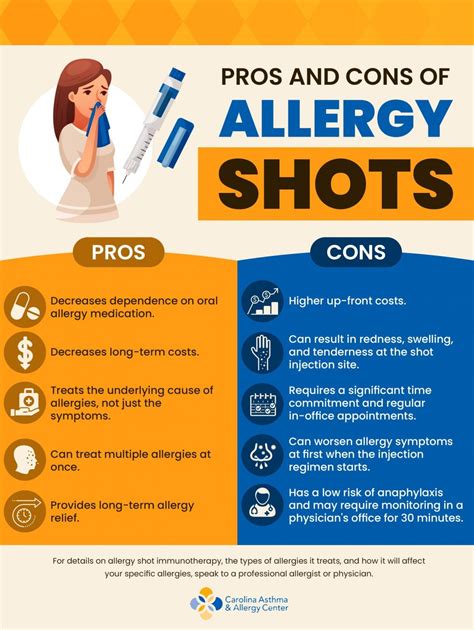

Pet health care insurance offers a multitude of advantages, going beyond the obvious financial relief. Here’s a closer look at some of the key benefits:

- Peace of Mind: Knowing that your pet is covered for unexpected medical emergencies provides a sense of security and allows you to focus on their recovery rather than financial worries.

- Access to Advanced Care: With insurance, you can access cutting-edge veterinary treatments, including specialized surgeries, diagnostic tests, and medications, ensuring your pet receives the best possible care.

- Routine Care Coverage: Many policies also cover routine wellness check-ups, vaccinations, and preventive care, helping you stay on top of your pet's overall health and catch potential issues early on.

- Financial Planning: By spreading the cost of insurance premiums over time, pet owners can better manage their finances and avoid the burden of large, unexpected veterinary bills.

- Breed-Specific Coverage: Some insurance providers offer breed-specific plans, catering to the unique health concerns associated with certain breeds, ensuring tailored coverage for your pet's specific needs.

Navigating the World of Pet Health Care Insurance: Coverage Options and Considerations

When exploring pet health care insurance, it’s essential to understand the various coverage options available and how they can impact your pet’s well-being. Here’s a breakdown of some key considerations:

Types of Coverage:

Accident-Only Plans: These plans provide coverage for injuries resulting from accidents, such as fractures, lacerations, or poisoning. While they offer limited coverage, they can be a cost-effective option for pet owners on a budget.

Accident and Illness Plans: As the name suggests, these plans cover both accidents and illnesses, including conditions like diabetes, cancer, or digestive disorders. They provide more comprehensive coverage but may have higher premiums.

Wellness Plans: Wellness plans focus on preventive care and routine procedures, covering expenses like vaccinations, dental cleanings, and spaying/neutering. They are ideal for pet owners who want to prioritize their pet's long-term health and catch potential issues early.

Coverage Levels and Deductibles:

Pet health insurance policies typically offer different coverage levels, allowing you to choose the plan that best fits your budget and pet’s needs. These levels are often determined by the percentage of the veterinary bill the insurance company will cover. For example, a 70% coverage level means the insurance company will reimburse you for 70% of the eligible expenses, while you pay the remaining 30%.

Additionally, most policies have deductibles, which are the amount you must pay out of pocket before the insurance coverage kicks in. Deductibles can be annual or per-incident, and choosing a higher deductible can often result in lower premiums.

Pre-Existing Conditions and Waiting Periods:

It’s crucial to understand that most pet insurance providers have policies regarding pre-existing conditions. These are health issues that your pet had or showed symptoms of before you enrolled them in the insurance plan. Most insurers will not cover pre-existing conditions, so it’s essential to enroll your pet early to ensure comprehensive coverage.

Furthermore, waiting periods are another consideration. These are the periods of time you must wait after enrolling your pet before certain types of coverage take effect. Waiting periods can vary for accidents, illnesses, and routine care, so be sure to review these carefully when choosing a policy.

| Coverage Type | Description |

|---|---|

| Accident-Only | Covers injuries from accidents |

| Accident and Illness | Covers accidents and illnesses |

| Wellness | Focuses on preventive care and routine procedures |

The Impact of Pet Health Care Insurance: Real-Life Success Stories

To illustrate the true value of pet health care insurance, let’s explore a few real-life success stories where insurance made a significant difference in the lives of pets and their owners.

Case Study: Saving Sparky’s Life

Meet Sparky, a playful Golden Retriever who, at the age of 3, was diagnosed with a rare form of cancer. His owners, the Johnson family, had enrolled Sparky in a comprehensive pet health insurance plan when he was a puppy. Thanks to this foresight, they were able to access the best possible treatment for Sparky’s cancer, including specialized surgeries and chemotherapy.

The insurance coverage not only relieved the financial burden of these costly treatments but also gave the Johnsons peace of mind, allowing them to focus on Sparky's recovery. With the support of their insurance provider, they were able to navigate the complex world of veterinary oncology and provide Sparky with the best chance at a full recovery.

Case Study: Preventing Financial Strain with Routine Care

Sarah, a dedicated cat owner, enrolled her two kittens, Luna and Leo, in a wellness plan when they were just a few months old. This plan covered all their routine care needs, including vaccinations, parasite prevention, and annual check-ups. Over the years, Sarah has been able to keep her cats healthy and happy without worrying about the financial impact of these essential procedures.

The wellness plan has not only provided financial relief but has also allowed Sarah to stay on top of her cats' health, catching potential issues early. With regular check-ups and preventive care, Sarah can ensure Luna and Leo lead long, healthy lives, free from preventable illnesses.

The Future of Pet Health Care Insurance: Trends and Innovations

As the pet insurance industry continues to evolve, several trends and innovations are shaping the future of pet health care. Here’s a glimpse into what we can expect:

Telemedicine and Remote Consultations:

With the rise of telemedicine in human healthcare, the pet insurance industry is also embracing this technology. Remote consultations and virtual veterinary services are becoming more common, allowing pet owners to access veterinary advice and even some treatments from the comfort of their homes. This trend is expected to continue, offering convenience and cost-effectiveness for pet owners.

Data-Driven Insights and Personalized Plans:

Advancements in data analytics and artificial intelligence are enabling pet insurance providers to offer more personalized plans based on individual pet profiles. By analyzing data on breed-specific health issues, lifestyle factors, and geographic locations, insurers can develop tailored coverage options, ensuring pets receive the most appropriate care for their unique needs.

Incentivizing Preventive Care:

Many pet insurance companies are recognizing the importance of preventive care in maintaining pet health and are incentivizing pet owners to prioritize it. This may include discounts on premiums for pets that stay up-to-date with their wellness checks and vaccinations, or even rewards programs that encourage pet owners to take a proactive approach to their pet’s health.

Expanding Coverage Options:

The pet insurance market is becoming increasingly competitive, leading to a wider range of coverage options. From plans that focus on specific conditions like joint health or dental care to those that offer coverage for alternative therapies like acupuncture or hydrotherapy, pet owners now have more choices to tailor their pet’s insurance plan to their unique needs.

How do I choose the right pet health insurance plan for my pet?

+Choosing the right pet health insurance plan involves several factors. Consider your pet's age, breed, and any pre-existing conditions. Evaluate the coverage options, including accident-only, accident and illness, or wellness plans. Assess your budget and choose a plan with a coverage level and deductible that suits your financial situation. Read reviews and compare providers to find the best fit for your needs.

Are there any age restrictions for enrolling my pet in insurance?

+Age restrictions for pet insurance enrollment vary between providers. Some insurers offer coverage for pets of all ages, while others may have upper age limits for enrolling new pets. It's best to research and compare providers to find one that suits your pet's age and health status.

What are the common exclusions in pet health insurance policies?

+Common exclusions in pet health insurance policies may include pre-existing conditions, breed-specific genetic disorders, cosmetic procedures, and intentional injuries. It's important to carefully review the policy's exclusions and limitations to understand what is and isn't covered.

Can I switch pet insurance providers if I'm not satisfied with my current plan?

+Yes, you can switch pet insurance providers if you're not satisfied with your current plan. However, it's important to carefully review the new provider's policy, including coverage options, pre-existing condition rules, and waiting periods. Ensure that any pre-existing conditions are properly covered and that you understand the terms of the new policy before making the switch.

How do I file a claim with my pet insurance provider?

+The process of filing a claim with your pet insurance provider may vary, but generally, you'll need to submit a claim form along with relevant documentation, such as veterinary invoices and medical records. Some providers offer online claim submission, while others may require you to mail or fax the necessary documents. It's important to review your policy's claim filing guidelines and keep all necessary records organized for a smooth claims process.

In conclusion, pet health care insurance is a vital tool for pet owners to ensure the well-being of their beloved companions. With a range of coverage options, peace of mind, and access to advanced veterinary care, insurance provides a safety net for pets and their families. As the industry continues to innovate and evolve, pet owners can look forward to even more tailored and comprehensive coverage options, further enhancing the health and happiness of our furry friends.