Understanding the intricacies of wage laws in Ohio is crucial for both employers and employees to ensure compliance and fair compensation. The Ohio wage laws are designed to protect workers' rights, outlining the minimum requirements for pay, overtime, and other employment-related aspects. Here are five key tips regarding Ohio wage laws that can help navigate these regulations effectively.

Key Points

- Minimum Wage: Ohio's minimum wage is higher than the federal minimum wage, and it applies to most employees, with exceptions for certain types of workers.

- Overtime Pay: Employers must pay overtime to non-exempt employees who work over 40 hours in a workweek, with a few exceptions.

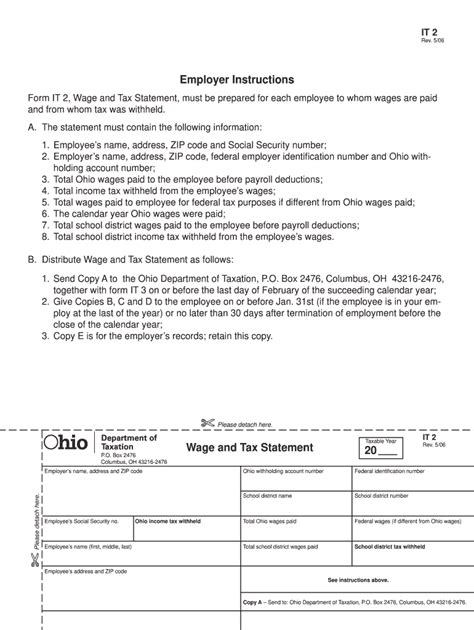

- Wage Payment Laws: Employers are required to pay wages at least twice a month, on a regular pay schedule, and must provide a statement of earnings for each pay period.

- Tipped Employees: The law treats tipped employees differently, allowing employers to pay a lower minimum wage as long as the employee's tips bring their earnings up to the minimum wage level.

- Record Keeping: Accurate and detailed record-keeping is essential for employers to comply with Ohio wage laws, including records of hours worked, wages paid, and other employment-related data.

Understanding Minimum Wage in Ohio

The minimum wage in Ohio is adjusted annually for inflation. As of the last update, the minimum wage for non-tipped employees is 9.30 per hour for employers with annual gross receipts of 342,000 or more. For tipped employees, the minimum wage is 4.65 per hour, with the understanding that tips will make up the difference to at least the standard minimum wage. Employers with smaller annual gross receipts may pay a lower minimum wage of 7.25 per hour for non-tipped employees, matching the federal minimum wage.

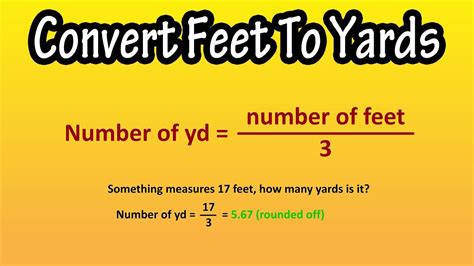

Overtime Pay Requirements

Overtime pay in Ohio follows the federal Fair Labor Standards Act (FLSA) guidelines, which require employers to pay overtime to non-exempt employees who work more than 40 hours in a workweek. The overtime rate is at least 1.5 times the employee’s regular rate of pay. There are exceptions for certain types of employees, such as those in executive, administrative, or professional roles, who are considered exempt from overtime requirements.

Wage Payment Laws and Tipped Employees

Ohio’s wage payment laws dictate that employers must pay wages at least twice a month, on a regular pay schedule. Employers must also provide a statement of earnings for each pay period, which includes the employee’s name, hours worked, rate of pay, gross and net earnings, and any deductions. For tipped employees, employers can take a tip credit, which means they can pay a lower minimum wage as long as the employee’s tips, when added to the lower minimum wage, equal or exceed the standard minimum wage.

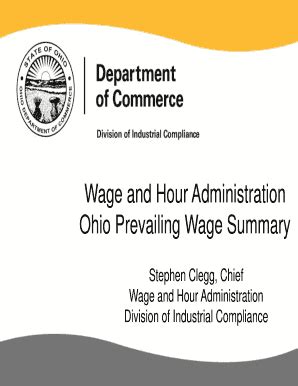

Record Keeping and Compliance

Accurate record-keeping is vital for compliance with Ohio wage laws. Employers must maintain records of hours worked, wages paid, and other employment-related data. These records must be kept for a specified period and be available for inspection by the Ohio Department of Commerce or other regulatory agencies. Failure to maintain these records can lead to fines and penalties, even if there are no other violations of wage laws.

| Employer Category | Minimum Wage | Overtime Eligibility |

|---|---|---|

| Large Employers (>$342,000 annual gross receipts) | $9.30/hour (non-tipped), $4.65/hour (tipped) | Eligible for overtime after 40 hours/week |

| Small Employers (<$342,000 annual gross receipts) | $7.25/hour | Eligible for overtime after 40 hours/week, unless exempt |

Addressing Potential Objections or Limitations

While Ohio wage laws provide a framework for fair compensation, there may be objections or limitations from both employers and employees. Employers might argue that higher minimum wages increase operational costs, potentially leading to reduced hiring or employee benefits. On the other hand, employees might argue that the minimum wage does not keep pace with the cost of living, especially in urban areas. Addressing these concerns requires a nuanced understanding of economic impacts and the importance of a living wage.

Evidence-Based Analysis

Studies have shown that raising the minimum wage can have both positive and negative effects on the economy. On the positive side, higher wages can increase consumer spending, reduce employee turnover, and improve overall economic output. However, there is also evidence to suggest that significant increases in the minimum wage can lead to job losses, particularly in low-margin industries. A balanced approach, considering both the needs of employees for a living wage and the challenges faced by employers, is crucial for effective policy-making.

What is the current minimum wage in Ohio for non-tipped employees?

+As of the last update, the minimum wage in Ohio for non-tipped employees is $9.30 per hour for employers with annual gross receipts of $342,000 or more.

How often must employers pay wages in Ohio?

+Employers in Ohio are required to pay wages at least twice a month, on a regular pay schedule.

What records must employers keep regarding employee wages and hours?

+Employers must keep accurate records of hours worked, wages paid, and other employment-related data, which must be maintained for a specified period and be available for inspection by regulatory agencies.

In conclusion, navigating Ohio wage laws requires a comprehensive understanding of minimum wage requirements, overtime pay, wage payment laws, and record-keeping obligations. By staying informed and adhering to these regulations, employers can avoid legal issues and maintain a positive working relationship with their employees. As the economic landscape continues to evolve, it’s essential to address the potential objections and limitations of wage laws, striving for policies that balance the needs of both employers and employees.