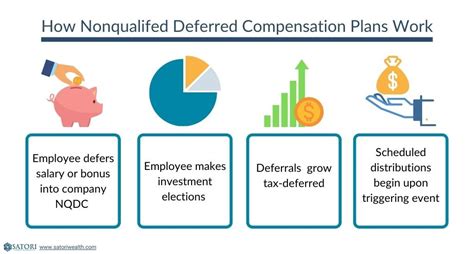

New York State's Deferred Compensation Plan is a valuable retirement savings tool for state and local government employees. With its flexible contribution options and range of investment choices, it can be an effective way to build a nest egg for the future. However, navigating the plan's features and making the most of its benefits can be daunting, especially for those who are new to retirement planning. Here, we'll explore five essential tips to help you get the most out of your NYS Deferred Comp plan.

Key Points

- Understand the plan's contribution limits and catch-up provisions to maximize your savings.

- Take advantage of the plan's range of investment options to create a diversified portfolio.

- Consider consolidating other retirement accounts into your NYS Deferred Comp plan for streamlined management.

- Utilize the plan's loan provisions and hardship withdrawal options, if necessary, but be aware of the potential impact on your long-term savings.

- Develop a comprehensive retirement strategy that incorporates your NYS Deferred Comp plan, as well as other retirement savings vehicles and income sources.

Tip 1: Maximize Your Contributions

To get the most out of your NYS Deferred Comp plan, it’s essential to contribute as much as possible, especially if your employer offers matching contributions. The plan allows you to contribute up to 100% of your eligible income, up to the annual limit set by the IRS. For the 2023 plan year, this limit is 22,500 for those under age 50, and 30,000 for those 50 and older, who are eligible to make catch-up contributions. By contributing the maximum amount, you can reduce your taxable income, lower your tax liability, and build a more substantial retirement nest egg.

Understanding Contribution Limits and Catch-Up Provisions

It’s crucial to understand the plan’s contribution limits and catch-up provisions to maximize your savings. If you’re 50 or older, you can make catch-up contributions, which allow you to contribute an additional $7,500 to your plan in 2023. This can be especially beneficial if you’re nearing retirement and want to boost your savings. Additionally, if you’ve contributed to other retirement plans in the past, you may be able to consolidate those accounts into your NYS Deferred Comp plan, which can help you manage your retirement savings more efficiently.

| Contribution Type | 2023 Limit |

|---|---|

| Regular Contribution | $22,500 |

| Catch-Up Contribution (age 50+) | $7,500 |

| Total Contribution (age 50+) | $30,000 |

Tip 2: Diversify Your Investments

A well-diversified investment portfolio is essential for long-term retirement savings success. The NYS Deferred Comp plan offers a range of investment options, including stocks, bonds, and mutual funds, which can help you spread risk and potentially increase returns over time. By allocating your contributions across different asset classes, you can create a portfolio that aligns with your risk tolerance, investment horizon, and retirement goals.

Investment Options and Portfolio Management

The plan’s investment options include a variety of funds and portfolios managed by experienced investment managers. You can choose from a range of asset classes, including domestic and international stocks, bonds, and real estate. It’s essential to regularly review and adjust your investment portfolio to ensure it remains aligned with your retirement goals and risk tolerance. You may also want to consider consulting with a financial advisor or using the plan’s online investment tools to help you make informed investment decisions.

Tip 3: Consolidate Other Retirement Accounts

If you have other retirement accounts, such as a 401(k) or IRA, you may be able to consolidate them into your NYS Deferred Comp plan. This can help you streamline your retirement savings and make it easier to manage your accounts. By consolidating your accounts, you can also potentially reduce fees and improve your investment options.

Consolidation Benefits and Considerations

Consolidating your retirement accounts can have several benefits, including simplified account management, reduced fees, and improved investment options. However, it’s essential to carefully consider the potential implications of consolidation, including any potential tax consequences or changes to your investment options. You may want to consult with a financial advisor or tax professional to determine the best course of action for your individual circumstances.

Tip 4: Utilize Loan Provisions and Hardship Withdrawals

The NYS Deferred Comp plan allows you to take loans or hardship withdrawals from your account, if necessary. However, it’s essential to carefully consider the potential implications of these options, including the impact on your long-term retirement savings. Loans and hardship withdrawals can provide a source of funds in times of financial need, but they can also reduce your retirement savings and potentially lead to tax penalties.

Loan and Hardship Withdrawal Provisions

The plan’s loan provisions allow you to borrow up to 50% of your vested account balance, up to a maximum of $50,000. You can repay the loan through payroll deductions or lump sum payments. Hardship withdrawals are also available, but they are subject to a 10% penalty and income tax. It’s essential to carefully review the plan’s loan and hardship withdrawal provisions and consider alternative options before making a decision.

Tip 5: Develop a Comprehensive Retirement Strategy

A comprehensive retirement strategy is essential for achieving your long-term retirement goals. This should include a detailed analysis of your income sources, expenses, and retirement savings, as well as a plan for generating income in retirement. By developing a comprehensive retirement strategy, you can help ensure that you’re prepared for the challenges and opportunities of retirement.

Retirement Planning and Income Generation

Retirement planning involves more than just saving for retirement; it also requires a strategy for generating income in retirement. This can include a combination of sources, such as pensions, Social Security, annuities, and retirement account withdrawals. It’s essential to carefully consider your income needs and develop a plan for generating income that will last throughout your retirement.

What is the contribution limit for the NYS Deferred Comp plan in 2023?

+The contribution limit for the NYS Deferred Comp plan in 2023 is $22,500 for those under age 50, and $30,000 for those 50 and older, who are eligible to make catch-up contributions.

Can I consolidate other retirement accounts into my NYS Deferred Comp plan?

+Yes, you may be able to consolidate other retirement accounts into your NYS Deferred Comp plan, but it's essential to carefully consider the potential implications and consult with a financial advisor or tax professional if necessary.

What are the loan provisions and hardship withdrawal options available in the NYS Deferred Comp plan?

+The plan's loan provisions allow you to borrow up to 50% of your vested account balance, up to a maximum of $50,000. Hardship withdrawals are also available, but they are subject to a 10% penalty and income tax.

In conclusion, the NYS Deferred Comp plan is a valuable retirement savings tool that can help you build a secure financial future. By following these five tips, you can maximize your contributions, diversify your investments, consolidate other retirement accounts, utilize loan provisions and hardship withdrawals, and develop a comprehensive retirement strategy. Remember to carefully consider your individual circumstances and consult with a financial advisor or tax professional if necessary to ensure that you’re making the most of your NYS Deferred Comp plan.