Managing finances effectively is crucial for individuals living in New York, given the state's high cost of living. Understanding how to navigate paycheck laws, deductions, and benefits can significantly impact one's financial stability and planning. New York paycheck laws are designed to protect employees' rights, ensuring fair compensation and transparency in payroll practices. Here are some key tips and insights to help New Yorkers make the most out of their paychecks.

Understanding New York Paycheck Laws

New York has specific laws governing paychecks, including how often employees must be paid, the information that must be included on pay stubs, and the rules surrounding deductions. For instance, New York Labor Law requires that most employees be paid at least semimonthly, with certain exceptions for manual workers who must be paid weekly. It’s essential for employees to be aware of these laws to ensure they are being paid correctly and on time.

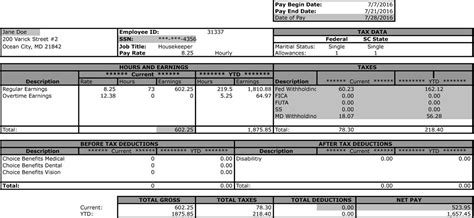

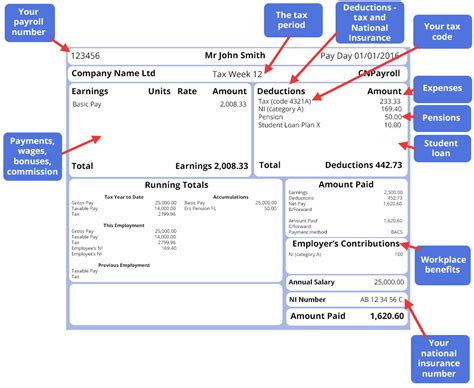

Required Pay Stub Information

Employers in New York are required to provide detailed pay stubs or a statement of wages with each payment of wages. This statement must include the dates of work covered by the payment, the employee’s name, the rate or rates of pay and the basis thereof (whether paid by hour, shift, day, week, etc.), the gross wages, the deductions, and the net wages. Understanding this information can help employees track their earnings and deductions accurately.

| Category | Description |

|---|---|

| Gross Wages | Total earnings before deductions |

| Deductions | Specific amounts withheld for taxes, insurance, etc. |

| Net Wages | Total take-home pay after deductions |

Managing Deductions and Benefits

Deductions are an essential aspect of paycheck management. They can include federal, state, and local taxes, as well as deductions for health insurance, retirement plans, and other benefits. New York offers various benefits and tax credits that can impact one’s net pay. For example, the New York State Child and Dependent Care Credit can provide significant tax savings for working families. Understanding and maximizing these benefits can significantly enhance one’s financial situation.

Tax Credits and Benefits

Beyond paycheck deductions, New Yorkers can benefit from various tax credits designed to support low- and moderate-income working individuals and families. The Earned Income Tax Credit (EITC) is a federal tax credit, but New York also offers a state EITC, which can provide additional tax savings. Being aware of these credits and how to claim them can lead to a more substantial refund or reduced tax liability.

Key Points

- Understand New York paycheck laws to ensure correct and timely payment.

- Regularly review pay stubs for accuracy and to track earnings and deductions.

- Maximize deductions and benefits, such as health insurance and retirement plans.

- Explore and claim applicable tax credits, like the EITC, to reduce tax liability.

- Plan finances effectively, considering net pay, expenses, and savings goals.

Financial Planning and Budgeting

Effective financial planning and budgeting are crucial for making the most out of one’s paycheck. This involves understanding one’s net pay, expenses, debts, and savings goals. Creating a budget that accounts for necessary expenses, savings, and debt repayment can help individuals manage their finances more efficiently. Tools like the 50/30/20 rule, where 50% of income goes to necessities, 30% to discretionary spending, and 20% to saving and debt repayment, can provide a structured approach to financial planning.

Debt Management and Savings

For many, managing debt is a significant part of financial planning. High-interest debts, such as credit card balances, should be prioritized for early payment. Savings are also essential, not just for long-term goals like retirement but also for short-term emergencies. Aim to save enough to cover at least 3-6 months of living expenses in an easily accessible savings account. Employers may also offer benefits like 401(k) matching, which can be a valuable resource for building retirement savings.

By understanding New York paycheck laws, managing deductions and benefits effectively, and practicing sound financial planning and budgeting, individuals can better navigate their financial lives and achieve greater stability and security.

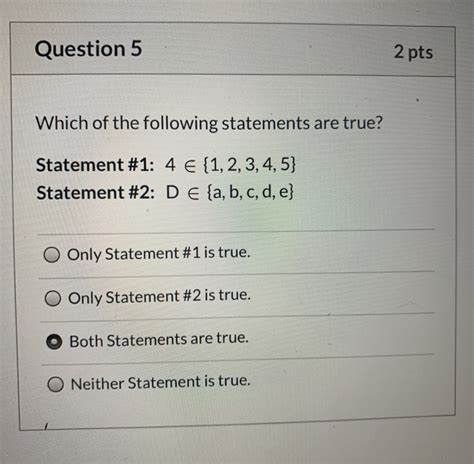

What are the primary paycheck laws in New York that employees should be aware of?

+New York paycheck laws include requirements for the frequency of pay, the information that must be included on pay stubs, and rules governing deductions. Employees must be paid at least semimonthly, with certain exceptions, and pay stubs must detail wages, deductions, and net pay.

How can employees in New York ensure they are taking advantage of all available tax credits and benefits?

+Employees can ensure they are taking advantage of all available tax credits and benefits by consulting with a tax professional, reviewing information provided by the New York State Department of Taxation and Finance, and staying informed about changes in tax law and available credits.

What role does financial planning play in making the most out of one’s paycheck in New York?

+Financial planning plays a crucial role in making the most out of one’s paycheck in New York. It involves creating a budget, managing debt, saving for emergencies and retirement, and making informed decisions about benefits and deductions. Effective financial planning can help individuals achieve financial stability and meet their long-term goals.