Health insurance is an essential aspect of life, ensuring that individuals and families have access to necessary medical care without facing financial burdens. In North Carolina, the state health insurance system plays a crucial role in providing coverage to residents, including students and employees of the esteemed North Carolina State University (NC State). This article delves into the intricacies of NC State health insurance, offering a comprehensive guide to understanding the benefits, coverage options, and enrollment processes for students, faculty, and staff.

Understanding NC State Health Insurance

NC State, through its commitment to the well-being of its community, offers comprehensive health insurance plans to its students, faculty, and staff. These plans are designed to meet the diverse needs of the university population, providing access to quality healthcare services and financial protection in the event of illness or injury.

Benefits of NC State Health Insurance

The health insurance plans offered by NC State come with a wide range of benefits, ensuring that policyholders receive the care they need when they need it. These benefits include:

- Comprehensive Medical Coverage: NC State health insurance plans cover a broad spectrum of medical services, from routine check-ups and preventative care to specialized treatments and hospital stays.

- Prescription Drug Coverage: Policyholders have access to discounted prescription medications, ensuring they can afford the medicines they require for optimal health.

- Mental Health Services: Recognizing the importance of mental well-being, NC State’s health plans include coverage for counseling, therapy, and psychiatric care.

- Vision and Dental Care: Regular eye exams and dental check-ups are covered, promoting overall health and preventing potential issues down the line.

- Emergency Care: In the event of an emergency, NC State health insurance provides coverage for urgent medical treatment, ensuring prompt access to necessary services.

- Maternity and Newborn Care: Expectant mothers and their newborns are supported with specialized care and coverage, ensuring a healthy start for the newest members of the NC State family.

Coverage Options

NC State understands that each individual has unique healthcare needs and preferences. As such, the university offers a variety of health insurance plans to cater to these diverse requirements. The primary coverage options include:

| Plan Type | Description |

|---|---|

| Student Health Insurance Plan (SHIP) | Designed specifically for NC State students, SHIP provides comprehensive coverage at an affordable rate. It includes access to on-campus healthcare services and a network of off-campus providers. |

| Faculty/Staff Health Insurance Plan | Tailored for NC State faculty and staff, this plan offers a range of coverage options, including PPO and HMO plans. It provides access to a wide network of healthcare providers and specialists. |

| Dependent Coverage | NC State extends health insurance coverage to the dependents of faculty and staff members, ensuring that entire families can access necessary healthcare services. |

Enrollment and Eligibility

Enrollment in NC State health insurance plans is typically conducted during designated open enrollment periods. However, certain life events, such as marriage, birth of a child, or loss of other health coverage, may trigger a special enrollment period.

Eligibility for health insurance at NC State is primarily determined by one’s relationship to the university. Students, faculty, and staff members are generally eligible for coverage, while dependents may also qualify for certain plans.

Enrollment Process

The enrollment process for NC State health insurance is designed to be straightforward and user-friendly. Here’s a step-by-step guide to assist you in navigating the process:

- Determine Eligibility: Confirm whether you are eligible for health insurance through NC State based on your status as a student, faculty member, or staff member.

- Choose Your Plan: Review the available health insurance plans and select the one that best meets your healthcare needs and budget. Consider factors such as coverage limits, deductibles, and co-pays.

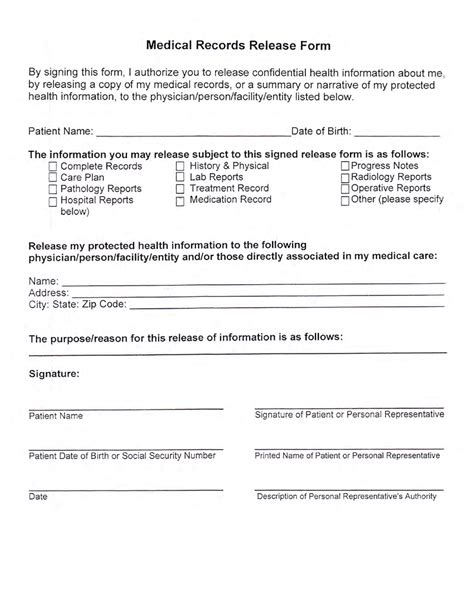

- Gather Required Documents: Prepare the necessary documentation, which typically includes proof of identity, residency, and relationship to the university (e.g., student ID, employee ID, marriage certificate, etc.).

- Complete the Enrollment Form: Access the online enrollment platform or obtain a paper enrollment form. Provide accurate and complete information, including personal details, emergency contacts, and healthcare preferences.

- Submit Your Application: Submit your completed enrollment form along with the required documents. You can typically do this online or by mail, depending on the university’s preferred method.

- Review and Verify: Once your application is received, the university will review and verify your eligibility and coverage choices. You may receive a confirmation email or letter outlining your coverage details.

- Pay Premiums: Health insurance plans typically require the payment of premiums, which can be done through the university’s online payment portal or by other accepted methods. Make sure to pay on time to avoid any lapses in coverage.

- Access Your Benefits: With your enrollment complete and premiums paid, you can now access your health insurance benefits. This includes utilizing on-campus healthcare services, visiting in-network providers, and taking advantage of the plan’s other offerings.

Utilizing NC State Health Insurance

Once enrolled in an NC State health insurance plan, it’s important to understand how to maximize your benefits and navigate the healthcare system effectively. Here are some key considerations:

- On-Campus Healthcare Services: NC State provides on-campus healthcare facilities, such as the Student Health Center and the Faculty/Staff Health Clinic. These centers offer a range of services, from primary care to specialized treatments, and are often a convenient and cost-effective option for policyholders.

- In-Network Providers: NC State health insurance plans typically have networks of preferred healthcare providers, including hospitals, clinics, and specialists. Utilizing in-network providers can result in lower out-of-pocket costs and streamlined claims processes.

- Understanding Your Plan: Take the time to review your health insurance plan’s summary of benefits and coverage details. This document outlines what is covered, including any exclusions or limitations, as well as your responsibilities as a policyholder.

- Filing Claims: If you receive medical treatment from an out-of-network provider or for services not covered by your plan, you may need to file a claim to be reimbursed. Familiarize yourself with the claims process and keep records of all medical expenses.

- Preventative Care: NC State health insurance plans often encourage preventative care, such as annual check-ups, vaccinations, and screenings. Taking advantage of these services can help detect potential health issues early on and prevent more serious conditions from developing.

FAQ

Can I enroll in NC State health insurance if I’m not a student, faculty, or staff member?

+

No, NC State health insurance plans are primarily designed for students, faculty, and staff members of the university. However, there may be certain circumstances, such as having a dependent relationship with an eligible individual, that could make you eligible for coverage.

What happens if I miss the open enrollment period?

+

If you miss the open enrollment period, you may still be able to enroll in NC State health insurance during a special enrollment period. These periods are typically triggered by specific life events, such as marriage, birth of a child, or loss of other health coverage. It’s important to check with the university’s human resources or insurance department to understand your options.

How can I find an in-network healthcare provider near me?

+

NC State provides online resources and tools to help you locate in-network healthcare providers. You can typically access these resources through the university’s health insurance website or by contacting the insurance provider directly. They will be able to guide you to providers in your area who participate in your specific health plan.

Conclusion

NC State health insurance offers a robust and comprehensive set of benefits to support the health and well-being of its community. By understanding the enrollment process, coverage options, and how to utilize your benefits, you can ensure you’re making the most of your health insurance plan. Remember, staying informed and proactive about your healthcare is key to maintaining a healthy and fulfilling life.