Insurance is an essential aspect of modern life, providing financial protection and peace of mind to individuals and businesses alike. It serves as a safety net, mitigating risks and ensuring that unforeseen events do not lead to devastating financial consequences. In this comprehensive article, we will delve into the world of insurance, exploring its various facets, the importance it holds, and the impact it has on our daily lives.

Understanding the Basics: What is Insurance?

Insurance is a contract, known as a policy, between an individual or entity (the policyholder) and an insurance company. This contract outlines the terms and conditions under which the insurance company agrees to compensate the policyholder for any losses or damages incurred as specified in the policy. In essence, insurance is a form of risk management, allowing individuals to transfer the financial burden of potential losses to an insurance provider.

The concept of insurance has a long and fascinating history, dating back to ancient civilizations. Early forms of insurance can be traced to practices like bottomry, where merchants borrowed money to fund their voyages, with the loan being forgiven if the ship sank. Over time, insurance evolved into a more sophisticated system, with the establishment of insurance companies and the development of various insurance products to cater to different needs.

The Role of Insurance in Modern Society

Insurance plays a vital role in modern society, offering a range of benefits that impact our lives in numerous ways.

Financial Security and Peace of Mind

One of the primary advantages of insurance is the financial security it provides. In the face of unexpected events such as accidents, illnesses, natural disasters, or business setbacks, insurance policies can help policyholders recover financially. Whether it’s covering medical expenses, repairing damaged property, or providing income during periods of disability, insurance acts as a safety net, ensuring that individuals and businesses can weather these storms without facing bankruptcy.

Risk Mitigation and Management

Insurance allows individuals and businesses to manage and mitigate risks effectively. By transferring the financial burden of potential losses to insurance companies, policyholders can focus on their core activities without the constant worry of unforeseen events. This risk management aspect of insurance is particularly crucial for businesses, as it enables them to make informed decisions, plan for the future, and protect their operations and assets.

Encouraging Responsible Behavior

Insurance policies often come with incentives that encourage responsible behavior. For instance, car insurance providers may offer discounts to drivers with clean records, rewarding those who drive safely and responsibly. Similarly, health insurance plans may provide incentives for policyholders to maintain a healthy lifestyle, promoting overall well-being. These incentives not only benefit the individual but also contribute to a safer and healthier society.

Stability and Economic Growth

The insurance industry plays a significant role in the overall stability and growth of economies. Insurance companies invest a substantial portion of their premiums in various financial instruments, which in turn contributes to the capital markets and stimulates economic activity. Additionally, insurance provides a safety net for businesses, allowing them to take calculated risks and innovate, which drives economic growth and development.

Types of Insurance: A Comprehensive Overview

The insurance industry offers a vast array of insurance products to cater to the diverse needs of individuals and businesses. Let’s explore some of the most common types of insurance and their specific applications.

Life Insurance

Life insurance is designed to provide financial protection to the policyholder’s beneficiaries in the event of their death. There are two main types of life insurance: term life insurance, which provides coverage for a specific period, and permanent life insurance, which offers lifelong coverage. Life insurance policies can help ensure that loved ones are financially secure even after the policyholder’s passing.

Health Insurance

Health insurance is vital for covering medical expenses, ensuring access to quality healthcare. It provides coverage for various medical services, including doctor visits, hospital stays, prescription medications, and more. With the rising costs of healthcare, health insurance is becoming increasingly crucial for individuals and families to manage their health-related expenses effectively.

Auto Insurance

Auto insurance, or car insurance, is mandatory in many countries and provides financial protection in the event of an accident. It covers damages to the policyholder’s vehicle, as well as any liability for injuries or property damage caused to others. Auto insurance policies can include different levels of coverage, such as liability-only, comprehensive, or collision coverage, depending on the policyholder’s needs and preferences.

Home Insurance

Home insurance, also known as property insurance, protects homeowners or renters from financial losses due to damages to their property. This can include coverage for fire, theft, natural disasters, and other specified perils. Home insurance policies often come with additional benefits, such as liability coverage for accidents that occur on the insured property.

Business Insurance

Business insurance is crucial for protecting commercial enterprises from various risks. It can include coverage for property damage, liability, business interruption, and more. Different industries have unique insurance needs, and business insurance policies are tailored to meet these specific requirements, ensuring that businesses can operate with confidence and mitigate potential financial losses.

Travel Insurance

Travel insurance provides coverage for unexpected events that may occur during a trip, such as trip cancellations, medical emergencies, lost luggage, or travel delays. It offers peace of mind to travelers, ensuring that they can enjoy their journeys without worrying about the financial implications of unforeseen circumstances.

Other Types of Insurance

In addition to the above, there are numerous other types of insurance policies available, each designed to address specific needs. These include disability insurance, pet insurance, dental insurance, umbrella insurance, and more. The insurance industry continues to innovate, creating new products to adapt to the changing needs and risks of individuals and businesses.

How Insurance Works: The Underwriting Process

The underwriting process is a crucial aspect of insurance, as it determines the eligibility and cost of insurance policies. Insurance underwriters assess the risk associated with each policyholder and use this information to determine the terms and conditions of the insurance contract.

Risk Assessment

Underwriters evaluate various factors to assess the risk associated with a potential policyholder. These factors can include age, health status, driving record, location, and more. By analyzing these factors, underwriters can determine the likelihood of a claim being filed and the potential cost of that claim. This assessment helps insurance companies price policies accurately and ensure that they can fulfill their obligations.

Policy Terms and Conditions

Based on the risk assessment, underwriters determine the terms and conditions of the insurance policy. This includes the coverage limits, deductibles, and any exclusions or limitations. The policy terms outline what is covered and what is not, ensuring that policyholders understand their rights and responsibilities.

Premiums and Payment

Insurance premiums are the amounts that policyholders pay to the insurance company to maintain their coverage. The premium is calculated based on the risk assessment and the terms of the policy. Policyholders typically pay their premiums on a regular basis, such as monthly or annually, to keep their insurance active.

Claims and Settlements

When a policyholder experiences a covered loss or damage, they can file a claim with their insurance company. The claims process involves providing documentation and evidence to support the claim. The insurance company then evaluates the claim, assesses the damages, and, if the claim is valid, provides a settlement to the policyholder in accordance with the terms of the policy.

The Impact of Insurance: Real-Life Examples

To illustrate the significance of insurance, let’s explore a few real-life scenarios where insurance played a crucial role.

Natural Disaster Recovery

In the aftermath of a devastating natural disaster, such as a hurricane or earthquake, insurance can make a world of difference. Policyholders with adequate home insurance coverage can receive financial assistance to repair or rebuild their homes, helping them recover and get back on their feet more quickly. Without insurance, the financial burden of such disasters could be overwhelming, leading to long-term displacement and hardship.

Medical Emergency and Health Insurance

Health insurance is invaluable when facing a medical emergency. Imagine a scenario where an individual suddenly requires emergency surgery. Without health insurance, the cost of this procedure could be astronomical, potentially leading to financial ruin. However, with health insurance, the policyholder can access the necessary medical care without worrying about the financial implications, allowing them to focus on their recovery.

Business Continuity and Commercial Insurance

Commercial insurance is critical for businesses to ensure their continuity in the face of unexpected events. Consider a small business that experiences a fire, damaging its premises and inventory. Without adequate business insurance, the business owner may struggle to recover and may even be forced to shut down permanently. However, with the right insurance coverage, the business can receive compensation for its losses, repair its premises, and continue operating, minimizing the disruption to its operations and customers.

The Future of Insurance: Innovations and Trends

The insurance industry is continuously evolving, driven by technological advancements and changing consumer needs. Here are some key trends and innovations shaping the future of insurance.

Digital Transformation

The digital revolution has had a significant impact on the insurance industry, with many companies embracing digital technologies to enhance their operations. This includes the use of online platforms for policy management, claims processing, and customer service. Digital transformation also enables insurance companies to leverage data analytics and artificial intelligence to improve risk assessment and pricing, leading to more efficient and personalized insurance solutions.

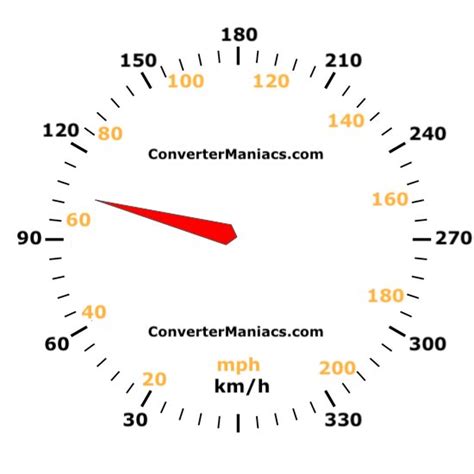

Telematics and Usage-Based Insurance

Telematics is a technology that uses sensors and data transmission to track and analyze driving behavior. This data is then used to determine insurance premiums, with safer drivers potentially receiving discounts on their auto insurance policies. Usage-based insurance, also known as pay-as-you-drive insurance, is gaining popularity, as it rewards responsible driving and provides more accurate pricing for insurance coverage.

Parametric Insurance

Parametric insurance is a relatively new concept that provides coverage based on predefined parameters, such as weather conditions or natural disasters. This type of insurance offers rapid payouts based on the occurrence of a specified event, rather than waiting for individual claims to be assessed and approved. Parametric insurance is particularly beneficial for businesses and individuals in high-risk areas, providing quick access to funds when they need it most.

Blockchain and Smart Contracts

Blockchain technology and smart contracts have the potential to revolutionize the insurance industry. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. These contracts can automate various insurance processes, such as claims processing and policy administration, reducing the need for manual intervention and potential errors. Blockchain technology also enhances data security and transparency, improving trust between insurance providers and policyholders.

Wellness and Lifestyle-Based Insurance

Insurance companies are increasingly recognizing the importance of wellness and healthy lifestyles. Many health insurance providers now offer incentives and discounts to policyholders who adopt healthy habits, such as regular exercise, healthy eating, and smoking cessation. This shift towards wellness-based insurance not only benefits individuals but also contributes to a healthier society and potentially reduces long-term healthcare costs.

Conclusion: The Importance of Insurance in Our Lives

Insurance is an indispensable aspect of modern life, offering financial protection, peace of mind, and stability to individuals and businesses. From life insurance to health insurance, auto insurance to business insurance, the various types of insurance policies cater to a wide range of needs and risks. The insurance industry continues to innovate, leveraging technology and data to enhance its services and provide more personalized and efficient solutions.

By understanding the role of insurance and the impact it has on our lives, we can make informed decisions about our insurance coverage and ensure that we are adequately protected against the uncertainties of life. Insurance allows us to face the future with confidence, knowing that we have a safety net to support us in times of need. So, whether it's protecting our health, our homes, or our businesses, insurance remains an essential tool for managing risks and securing our financial well-being.

What are the benefits of having insurance?

+Insurance provides financial protection and peace of mind. It helps individuals and businesses manage risks, recover from unexpected events, and maintain stability. Insurance policies offer coverage for various aspects of life, including health, property, vehicles, and businesses, ensuring that policyholders can mitigate potential losses and maintain their financial security.

How does insurance help in times of financial hardship?

+Insurance acts as a safety net during financial hardships. For example, in the event of a serious illness or accident, health insurance can cover medical expenses, reducing the financial burden on the policyholder. Similarly, property insurance can provide compensation for damages caused by natural disasters or accidents, helping individuals and businesses rebuild and recover.

What are some common types of insurance and their purposes?

+Common types of insurance include life insurance, which provides financial protection for beneficiaries in the event of the policyholder’s death; health insurance, covering medical expenses; auto insurance, protecting against vehicle-related damages and liabilities; home insurance, safeguarding property; and business insurance, which offers coverage for commercial enterprises against various risks.

How does the underwriting process work in insurance?

+The underwriting process involves assessing the risk associated with a potential policyholder. Underwriters evaluate factors such as age, health, driving record, and location to determine the likelihood of a claim being filed. Based on this risk assessment, they set the terms and conditions of the insurance policy, including coverage limits, deductibles, and premiums.

What are some emerging trends in the insurance industry?

+Emerging trends in insurance include digital transformation, with insurance companies leveraging online platforms and data analytics for improved efficiency. Telematics and usage-based insurance are gaining popularity, rewarding safe driving behavior. Parametric insurance offers rapid payouts based on predefined parameters, while blockchain and smart contracts enhance data security and automate insurance processes. Wellness-based insurance incentivizes healthy lifestyles.