Medical debt has become a significant concern for many individuals in the United States, with millions of people struggling to pay their medical bills. When medical debt goes unpaid, it can be sent to collections and eventually reported to the credit bureaus, potentially damaging one's credit score. The impact of medical debt on credit reports is a complex issue, involving various stakeholders, including healthcare providers, insurance companies, collection agencies, and credit reporting agencies. In this article, we will delve into the world of medical debt and its effects on credit reports, exploring the current landscape, the consequences of medical debt, and potential solutions to mitigate its impact.

Key Points

- Medical debt can significantly impact credit scores, with even small debts potentially lowering scores by 100 points or more.

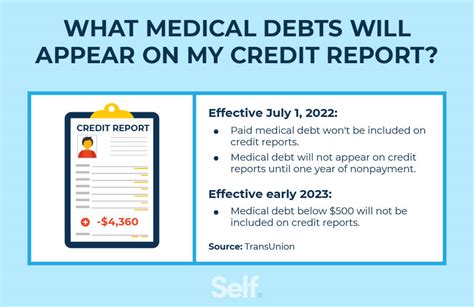

- The three major credit reporting agencies (Equifax, Experian, and TransUnion) have implemented changes to how medical debt is reported, including a 180-day waiting period before reporting.

- Some collection agencies specialize in medical debt, using aggressive tactics to collect debts, which can lead to further financial hardship for individuals.

- Insurance companies and healthcare providers often have complex billing processes, which can contribute to medical debt and subsequent credit reporting issues.

- Policymakers and consumer advocacy groups are working to address the issue of medical debt and its impact on credit reports, with proposed solutions including stricter regulations on collection agencies and credit reporting agencies.

Understanding Medical Debt and Credit Reports

Medical debt can arise from various sources, including hospital stays, surgical procedures, doctor visits, and prescription medications. When individuals are unable to pay their medical bills, healthcare providers may send the debt to collection agencies, which can report the debt to the credit bureaus. This can lead to a negative impact on credit scores, making it more difficult for individuals to obtain credit, loans, or even secure employment. According to a study by the Consumer Financial Protection Bureau (CFPB), medical debt is the most common type of debt in collections, with over 43 million consumers having medical debt in collections.

The Consequences of Medical Debt on Credit Reports

The consequences of medical debt on credit reports can be severe. A single medical debt can lower a credit score by 100 points or more, depending on the individual’s credit history and the amount of debt. This can make it challenging for individuals to obtain credit, loans, or even secure employment. Furthermore, medical debt can remain on credit reports for seven years, even if the debt is paid or settled. This can have long-lasting effects on an individual’s creditworthiness and financial stability.

| Medical Debt Collection | Percentage of Consumers |

|---|---|

| Medical debt in collections | 43 million (14% of consumers) |

| Medical debt on credit reports | 21% of consumers |

| Average medical debt amount | $1,300 |

Current Landscape and Proposed Solutions

The current landscape of medical debt and credit reporting is complex and multifaceted. Policymakers, consumer advocacy groups, and industry stakeholders are working to address the issue of medical debt and its impact on credit reports. Proposed solutions include stricter regulations on collection agencies and credit reporting agencies, as well as efforts to improve transparency and accuracy in medical billing and credit reporting. Some lawmakers have also proposed legislation to remove medical debt from credit reports altogether, arguing that it is an unfair and unnecessary burden on consumers.

Industry Perspectives and Consumer Advocacy

Industry stakeholders, including healthcare providers, insurance companies, and collection agencies, have varying perspectives on the issue of medical debt and credit reporting. Some argue that medical debt is a legitimate concern and that credit reporting is a necessary tool for ensuring that individuals are held accountable for their debts. Others argue that the current system is unfair and that medical debt should not be reported to the credit bureaus. Consumer advocacy groups, such as the National Consumer Law Center, argue that medical debt is a significant concern and that policymakers must take action to protect consumers from unfair and abusive practices.

What is medical debt, and how does it affect credit reports?

+Medical debt arises from unpaid medical bills, which can be sent to collection agencies and reported to the credit bureaus. This can lower credit scores, making it more difficult to obtain credit, loans, or employment.

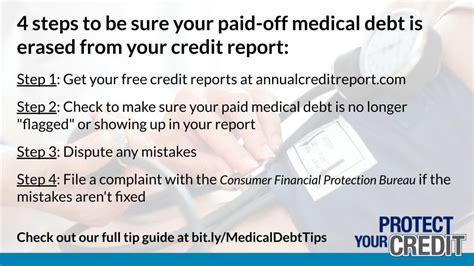

How can I prevent medical debt from affecting my credit report?

+To prevent medical debt from affecting your credit report, it is essential to review your medical bills carefully, ensure that you understand your insurance coverage, and communicate with your healthcare provider and insurance company to resolve any billing issues promptly.

What are the proposed solutions to address the issue of medical debt and credit reporting?

+Proposed solutions include stricter regulations on collection agencies and credit reporting agencies, efforts to improve transparency and accuracy in medical billing and credit reporting, and legislation to remove medical debt from credit reports altogether.

In conclusion, the issue of medical debt and its impact on credit reports is a complex and multifaceted concern. While there are proposed solutions and efforts underway to address this issue, it is essential for consumers to be aware of the potential consequences of medical debt and to take proactive steps to protect their credit reports. By understanding the current landscape and the proposed solutions, consumers can make informed decisions about their financial health and well-being.