In the ever-evolving landscape of personal finance and property protection, finding the right homeowners insurance policy that offers comprehensive coverage at a competitive price is a priority for many homeowners. This guide delves into the intricacies of low-price homeowners insurance, exploring how you can secure the best protection for your home without breaking the bank.

Understanding Low-Price Homeowners Insurance

Low-price homeowners insurance, also known as discounted or budget-friendly policies, is designed to provide essential coverage for homeowners at a reduced cost. These policies are tailored to meet the needs of budget-conscious individuals without compromising on the vital aspects of homeowners insurance.

The key to low-price homeowners insurance lies in understanding your specific needs and finding a policy that offers the right coverage at a competitive rate. While these policies may have certain limitations compared to more comprehensive plans, they can still provide adequate protection for your home and belongings.

What Does Low-Price Homeowners Insurance Cover?

The coverage offered by low-price homeowners insurance policies can vary depending on the provider and the specific plan chosen. However, there are several standard coverages that are commonly included:

- Dwelling Coverage: This protects the physical structure of your home, including the roof, walls, and permanent fixtures. It covers damages caused by perils such as fire, lightning, windstorms, and vandalism.

- Personal Property Coverage: This coverage reimburses you for the loss or damage of your personal belongings, such as furniture, electronics, and clothing. It typically covers damages from the same perils as dwelling coverage.

- Liability Coverage: This provides protection in case someone is injured on your property or if your actions cause damage to someone else's property. It covers legal fees and any settlements or judgments you may need to pay.

- Additional Living Expenses: In the event that your home becomes uninhabitable due to a covered peril, this coverage reimburses you for the additional costs of temporary housing and other living expenses.

- Medical Payments: This coverage provides payment for medical expenses if someone is injured on your property, regardless of who is at fault.

It's important to note that low-price homeowners insurance policies may have lower coverage limits and higher deductibles compared to standard policies. Additionally, certain types of coverage, such as flood or earthquake insurance, may be excluded or offered as optional add-ons.

How to Get the Best Low-Price Homeowners Insurance

To secure the best low-price homeowners insurance, it’s essential to shop around and compare multiple providers. Different insurance companies offer various discounts and coverage options, so it’s crucial to explore your options thoroughly.

Here are some tips to help you find the best low-price homeowners insurance:

- Compare Quotes: Request quotes from multiple insurance providers to compare prices and coverage options. Online comparison tools can be a convenient way to get a quick overview of different policies.

- Understand Your Needs: Assess your specific needs and prioritize the coverages that are most important to you. Consider factors like the value of your home, the cost of rebuilding, and the replacement value of your belongings.

- Explore Discounts: Many insurance companies offer discounts for various reasons, such as having a security system installed, being a loyal customer, or bundling your homeowners insurance with other policies like auto insurance.

- Consider Deductibles: Higher deductibles can lower your premium, but it's important to choose a deductible that you can comfortably afford in the event of a claim. A higher deductible may make sense if you're confident you won't need to file frequent claims.

- Read the Fine Print: Carefully review the policy documents to understand the exclusions and limitations. Make sure you're aware of any conditions or restrictions that may apply to your coverage.

- Bundle Policies: Bundling your homeowners insurance with other policies, such as auto or life insurance, can often result in significant savings. Many insurance companies offer multi-policy discounts.

- Shop Around Regularly: Insurance rates and coverage options can change over time, so it's beneficial to shop around for new quotes every few years or whenever you make significant changes to your home or lifestyle.

Performance Analysis and Real-World Examples

To illustrate the effectiveness of low-price homeowners insurance, let’s consider a few real-world scenarios and analyze how these policies perform in different situations.

Scenario 1: Fire Damage

Imagine a homeowner, Sarah, who has a low-price homeowners insurance policy with a dwelling coverage limit of 250,000 and a personal property coverage limit of 100,000. Unfortunately, a fire breaks out in her home, causing extensive damage. The cost to rebuild the home is estimated at 300,000, and the replacement value of her belongings is 75,000.

In this scenario, Sarah's policy would cover the full cost of rebuilding her home, up to the policy limit of $250,000. However, the personal property coverage would only reimburse her up to the policy limit of $100,000, leaving her with a gap in coverage for the remaining $25,000 worth of belongings.

Scenario 2: Break-In and Theft

John, another homeowner, has a low-price homeowners insurance policy with 50,000 in personal property coverage. One night, burglars break into his home and steal his valuable electronics and jewelry, totaling 70,000 in losses.

In this case, John's policy would only cover up to the policy limit of $50,000. He would be responsible for the remaining $20,000 in losses, highlighting the importance of understanding the coverage limits of your policy.

Scenario 3: Natural Disaster

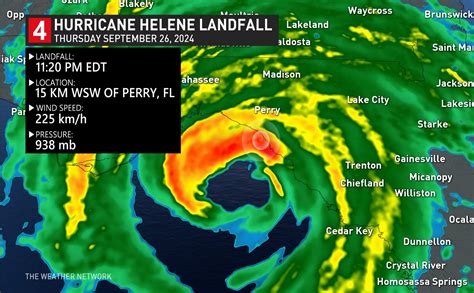

Let’s consider Emma, who lives in an area prone to hurricanes. She has a low-price homeowners insurance policy that includes coverage for windstorm damage. During a severe hurricane, her home sustains significant damage, including roof damage and broken windows. The repair costs are estimated at $35,000.

Fortunately, Emma's policy covers windstorm damage, and her insurance provider promptly processes her claim. The repairs are completed, and Emma's home is restored to its pre-storm condition.

Evidence-Based Future Implications

The demand for low-price homeowners insurance is expected to continue rising as more homeowners seek affordable coverage options. Insurance providers are likely to adapt their offerings to cater to this growing market, potentially resulting in more competitive rates and innovative coverage solutions.

As technology advances, the insurance industry is also exploring new ways to personalize and customize policies. This could lead to more tailored low-price homeowners insurance options, allowing homeowners to select specific coverages based on their unique needs and preferences.

Furthermore, the increasing popularity of smart home technology and security systems may influence insurance providers to offer discounts for homeowners who invest in these preventive measures. This could further reduce the cost of low-price homeowners insurance policies and encourage homeowners to adopt safer practices.

FAQs

How much does low-price homeowners insurance typically cost?

+The cost of low-price homeowners insurance can vary significantly based on factors such as location, the value of your home, and the coverage options you choose. On average, you can expect to pay anywhere from 500 to 1,500 per year for a basic policy. However, it’s essential to compare quotes from different providers to find the best rate for your specific circumstances.

Are there any downsides to choosing a low-price homeowners insurance policy?

+Low-price homeowners insurance policies often come with lower coverage limits and higher deductibles. This means you may have to pay a larger portion of the costs out of pocket in the event of a claim. Additionally, these policies may have more exclusions and limitations, so it’s crucial to carefully review the fine print to understand what’s covered and what’s not.

Can I customize my low-price homeowners insurance policy to meet my specific needs?

+Yes, many insurance providers offer customization options for low-price homeowners insurance policies. You can typically choose different levels of coverage for dwelling, personal property, and liability. Additionally, you may have the option to add endorsements or riders to your policy to cover specific items or situations, such as jewelry, fine art, or water backup damage.

How often should I review and update my low-price homeowners insurance policy?

+It’s recommended to review your homeowners insurance policy annually or whenever you make significant changes to your home or lifestyle. This ensures that your coverage remains adequate and up-to-date. Life events such as home renovations, additions, or purchasing expensive new belongings may require adjustments to your policy to maintain proper protection.