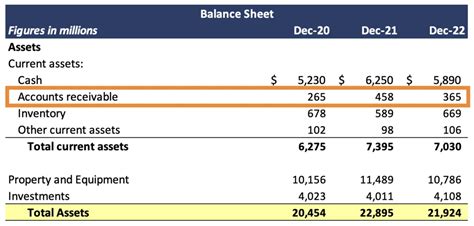

Accounts receivable is a fundamental concept in accounting and finance, representing the amount of money that customers owe to a business for goods or services purchased on credit. The classification of accounts receivable as an asset is crucial for understanding its impact on a company's financial statements and overall financial health. In this article, we will delve into the details of accounts receivable, its characteristics, and why it is considered an asset.

Definition and Characteristics of Accounts Receivable

Accounts receivable refers to the outstanding invoices or amounts that a business has billed to its customers but has not yet received payment for. These amounts are typically expected to be paid within a short period, usually 30, 60, or 90 days, depending on the company’s credit terms. The key characteristics of accounts receivable include its short-term nature, the expectation of payment, and the potential for default or bad debt.

Why Accounts Receivable is Considered an Asset

Accounts receivable is classified as a current asset on a company’s balance sheet because it represents a claim to future cash inflows. The reasoning behind this classification is based on the following principles:

- Economic Benefits: Accounts receivable represents the amount of money that customers owe to the business, which, when collected, will provide economic benefits in the form of cash inflows.

- Ownership: The business has a legal claim to the amounts owed by its customers, giving it ownership of these assets.

- Convertibility to Cash: Accounts receivable is expected to be converted into cash within a short period, usually within a year, making it a liquid asset.

| Accounts Receivable Category | Description |

|---|---|

| Trade Receivables | Amounts owed by customers for goods or services sold on credit. |

| Non-Trade Receivables | Amounts owed to the business for reasons other than the sale of goods or services, such as loans to employees or directors. |

Key Points

Key Points

- Accounts receivable represents the amount of money that customers owe to a business for goods or services purchased on credit.

- It is classified as a current asset on a company’s balance sheet due to its short-term nature and expectation of payment.

- The value of accounts receivable can be affected by factors such as customer creditworthiness, the age of the receivables, and collection policies.

- Effective management of accounts receivable is crucial for maintaining a healthy cash flow and minimizing the risk of bad debts.

- Accounts receivable is a critical component of a company’s working capital, which is essential for its day-to-day operations and long-term sustainability.

Managing Accounts Receivable

Effective management of accounts receivable is vital for maintaining a healthy cash flow and minimizing the risk of bad debts. This involves implementing efficient collection procedures, monitoring customer creditworthiness, and maintaining accurate records of outstanding invoices. By doing so, businesses can optimize their accounts receivable, reduce the risk of default, and ensure a stable financial foundation.

In conclusion, accounts receivable is indeed an asset that represents a critical component of a company's working capital. Its proper management is essential for maintaining a healthy cash flow, minimizing the risk of bad debts, and ensuring the long-term sustainability of the business. By understanding the characteristics and importance of accounts receivable, businesses can optimize their financial performance and make informed decisions about their credit policies and collection procedures.

What is the primary difference between accounts receivable and accounts payable?

+Accounts receivable represents the amount of money that customers owe to a business, while accounts payable represents the amount of money that a business owes to its suppliers or creditors.

How do businesses typically manage their accounts receivable?

+Businesses typically manage their accounts receivable by implementing efficient collection procedures, monitoring customer creditworthiness, and maintaining accurate records of outstanding invoices.

What are the potential risks associated with accounts receivable?

+The potential risks associated with accounts receivable include the risk of default or bad debt, the risk of delayed payment, and the risk of inaccurate or incomplete records.

Meta Description: Learn about accounts receivable, its characteristics, and why it’s considered an asset. Discover how to manage accounts receivable effectively and minimize the risk of bad debts.