In the intricate world of insurance, the process of making an insurance claim is a crucial aspect that directly impacts policyholders. This process, often complex and laden with legalities, requires a comprehensive understanding to navigate successfully. It involves several critical steps, from reporting the incident to receiving the claim settlement, and is influenced by various factors, including the type of insurance, policy terms, and the claim's nature.

This article aims to delve deep into the intricacies of the insurance claim process, providing an in-depth analysis of its various stages, potential challenges, and best practices. By doing so, it aims to empower readers with the knowledge to make informed decisions and effectively manage their insurance claims, thereby maximizing their benefits and ensuring a smoother process.

Understanding the Insurance Claim Process

The insurance claim process is a multifaceted journey that varies depending on the insurance type and the specifics of the claim. However, it generally involves a standardized set of steps that policyholders must navigate to receive their claim settlement.

Reporting the Incident

The first step in the insurance claim process is reporting the incident or loss to the insurance company. This step is critical as it initiates the claim process and triggers the insurer’s investigation and assessment of the claim. Policyholders must ensure they report the incident promptly and accurately, providing all relevant details and supporting documentation.

For instance, in the case of an automobile accident, the policyholder would need to report the accident to their insurer, providing details such as the date, time, location, and circumstances of the accident. They would also need to provide the contact information of any other parties involved and any relevant witnesses. Additionally, they might need to submit photographs of the accident scene and the damaged vehicle.

Similarly, in the case of a home insurance claim, the policyholder would need to report the loss, such as a burst pipe or a burglary, to their insurer. They would need to provide details of the incident, including the date and time it occurred, and any relevant information about the cause of the loss. They might also need to submit photographs or videos of the damage and provide documentation, such as repair estimates or police reports, if applicable.

Claim Investigation and Assessment

Once the incident is reported, the insurance company initiates a thorough investigation and assessment of the claim. This step is crucial as it determines the validity and value of the claim. The insurer will examine the policy terms, the reported incident, and any supporting evidence provided by the policyholder.

During the investigation, the insurer might request additional information or documentation from the policyholder to clarify the details of the claim. They might also send an adjuster or assessor to inspect the damage or loss. For example, in the case of a property damage claim, the insurer might send an adjuster to assess the extent of the damage and determine the cost of repairs. They would consider factors such as the age and condition of the property, the extent of the damage, and any pre-existing conditions that might impact the claim.

Claim Approval and Settlement

If the claim is approved, the insurer will proceed to settle the claim, which typically involves a payment to the policyholder or a third party, such as a repair service or healthcare provider. The settlement amount is based on the policy terms, the extent of the loss, and the insurer’s assessment of the claim.

For instance, in the case of a health insurance claim, the insurer would review the policy terms, the medical services received, and the associated costs. They would then determine the amount payable under the policy, considering factors such as the policy's coverage limits, deductibles, and co-pays. The insurer would then settle the claim by reimbursing the policyholder or paying the healthcare provider directly, depending on the policy terms and the preference of the policyholder.

Appeals and Disputes

In some cases, the insurer might deny or dispute the claim, either fully or partially. This could occur if the insurer determines that the claim is not covered under the policy, if there is insufficient evidence to support the claim, or if there are indications of fraud or misrepresentation. If this happens, the policyholder has the right to appeal the decision and provide additional evidence or clarification to support their claim.

The appeals process varies depending on the insurer and the type of insurance. It might involve a review by a higher authority within the insurance company, an external mediator, or even legal proceedings. Policyholders should carefully review their policy documents and the insurer's claim process guidelines to understand their rights and the steps they need to take to appeal a denied claim.

Common Challenges and Best Practices

The insurance claim process can be complex and fraught with challenges. Understanding these challenges and implementing best practices can help policyholders navigate the process more effectively and increase their chances of a successful claim.

Documentation and Evidence

One of the key challenges in the insurance claim process is providing comprehensive and accurate documentation and evidence to support the claim. Policyholders should ensure they maintain thorough records, including photographs, videos, receipts, and other relevant documentation, to substantiate their claim.

For example, in the case of a theft claim, the policyholder should provide a detailed list of the stolen items, including their purchase price, age, and any relevant receipts or appraisals. They should also provide a police report documenting the theft. Similarly, in the case of a medical claim, the policyholder should maintain records of their medical treatments, including diagnoses, procedures, and associated costs.

Understanding Policy Terms

Another critical aspect of the insurance claim process is understanding the policy terms and conditions. Policyholders should carefully review their insurance policies to understand what is covered, what is excluded, and any specific requirements or limitations that might impact their claim.

For instance, some insurance policies might have specific requirements for reporting certain types of claims. They might require the policyholder to report the claim within a certain timeframe or provide specific types of documentation. Understanding these requirements can help policyholders avoid delays or denials due to non-compliance.

Communication and Collaboration

Effective communication and collaboration with the insurer are essential during the insurance claim process. Policyholders should maintain open lines of communication with their insurer, providing prompt responses to requests for information and being available for inspections or assessments.

Collaborating with the insurer can help policyholders understand the claim process better, clarify any doubts or concerns, and ensure a smoother claim journey. It can also help identify any potential issues or challenges early on, allowing for timely resolution and minimizing delays.

Seeking Professional Advice

In complex or high-value claims, seeking professional advice from an insurance broker, financial advisor, or legal expert can be beneficial. These professionals can provide specialized knowledge and guidance, helping policyholders navigate the claim process effectively and maximize their claim settlement.

For instance, a legal expert can provide advice on the legal aspects of the claim, such as liability, contractual obligations, and the appeals process. They can also assist in gathering and presenting evidence to support the claim, ensuring that the policyholder's rights are protected.

Future Implications and Innovations

The insurance industry is continually evolving, and the insurance claim process is no exception. Technological advancements and changing consumer expectations are driving innovations in the claim process, aiming to enhance efficiency, speed, and customer satisfaction.

Digitalization and Automation

Digitalization and automation are transforming the insurance claim process, making it more efficient and customer-centric. Insurers are leveraging technology to streamline the claim process, from reporting the incident to settling the claim.

For example, many insurers now offer digital claim reporting, allowing policyholders to report their claims online or through mobile apps. This not only saves time but also provides a more convenient and accessible way to initiate the claim process. Additionally, insurers are using automation and artificial intelligence to process and assess claims more efficiently, reducing the time and resources required for claim handling.

Enhanced Customer Experience

The focus on enhancing the customer experience is a significant trend in the insurance industry. Insurers are recognizing the importance of providing a seamless and satisfying claim experience, as this can significantly impact customer loyalty and satisfaction.

To achieve this, insurers are implementing various strategies, such as simplifying the claim process, providing clear and transparent communication, and offering personalized support. They are also investing in customer-centric technologies, such as chatbots and virtual assistants, to provide real-time assistance and guidance to policyholders during the claim process.

Data-Driven Claim Assessment

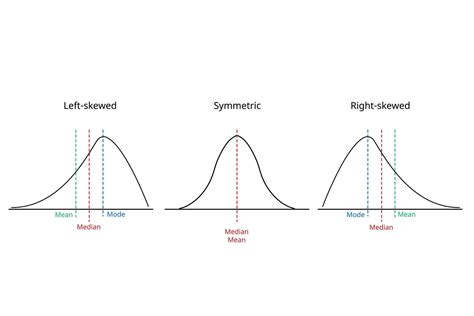

The increasing availability and sophistication of data analytics are transforming the way insurers assess and manage claims. By leveraging data, insurers can make more accurate and efficient claim decisions, reduce fraud, and improve operational efficiency.

For instance, insurers can use data analytics to identify patterns and trends in claim behavior, helping them detect potential fraud or misuse. They can also use data to improve their underwriting processes, allowing them to offer more tailored and accurate insurance coverage. Additionally, data analytics can help insurers better understand their customers' needs and preferences, enabling them to provide more personalized services and products.

Collaborative Partnerships

Insurers are also recognizing the value of collaborative partnerships to enhance the insurance claim process. By partnering with other organizations, such as repair services, healthcare providers, or technology companies, insurers can leverage specialized expertise and resources to improve the claim experience.

For example, insurers might partner with repair services to provide policyholders with access to a network of trusted and reliable repairers. This can help streamline the repair process, ensuring that policyholders receive high-quality repairs in a timely manner. Similarly, insurers might collaborate with healthcare providers to facilitate the medical claim process, ensuring that policyholders receive the necessary care and treatment while streamlining the claim settlement process.

What should I do if my insurance claim is denied?

+

If your insurance claim is denied, the first step is to carefully review the denial letter or notification provided by your insurer. This will outline the reasons for the denial and may provide information on your rights and the appeals process. It’s important to understand the specific grounds for the denial to determine your next steps.

If you believe the denial is unjustified or there has been a misunderstanding, you can initiate an appeal. This typically involves providing additional evidence or clarification to support your claim. It’s crucial to gather all relevant documentation and prepare a well-organized appeal, clearly addressing the points raised by the insurer.

If the appeal process does not lead to a favorable outcome, you may consider seeking professional advice from an insurance broker or legal expert. They can provide specialized guidance and assist you in understanding your rights and options, including the possibility of legal action.

How long does the insurance claim process typically take?

+

The duration of the insurance claim process can vary significantly depending on several factors, including the type of insurance, the complexity of the claim, and the insurer’s claim handling procedures.

For simpler claims with minimal documentation and straightforward assessment, the process can be relatively quick, often taking a few days to a few weeks. However, for more complex claims, such as those involving extensive damage, multiple parties, or legal proceedings, the process can take several weeks to months.

It’s important to maintain open communication with your insurer throughout the process to understand the timeline and any potential delays. They can provide updates on the progress of your claim and inform you of any steps you need to take to facilitate the process.

Can I negotiate the settlement amount for my insurance claim?

+

The settlement amount for an insurance claim is typically based on the policy terms, the extent of the loss, and the insurer’s assessment of the claim. However, there may be room for negotiation, especially in cases where the initial settlement offer does not adequately cover the loss or there are disputes over the value of the claim.

Policyholders can engage in negotiations with the insurer, providing additional evidence or expert opinions to support their claim for a higher settlement. It’s important to approach negotiations with a well-prepared case and a clear understanding of the policy terms and the insurer’s assessment process.

However, it’s also crucial to maintain a professional and respectful tone during negotiations. Insurers have their own guidelines and criteria for settling claims, and while they may be open to negotiation, they also have a responsibility to their shareholders and other policyholders to ensure fair and reasonable settlements.