Calculating the total cost of a project, product, or service is a crucial aspect of financial management, whether you're a business owner, project manager, or individual consumer. The ability to accurately determine total costs helps in making informed decisions, setting realistic budgets, and ensuring profitability. In this article, we will delve into the world of total cost calculation, exploring its principles, methodologies, and practical applications to provide a comprehensive understanding of how to calculate total cost easily and effectively.

Key Points

- Understanding the components of total cost, including direct costs, indirect costs, and overheads.

- Applying different cost calculation methods, such as the bottom-up approach and the top-down approach.

- Utilizing technology and software tools to streamline the cost calculation process.

- Considering the impact of inflation, taxes, and other external factors on total cost.

- Developing a flexible budgeting system to accommodate changes in project scope or market conditions.

Understanding Total Cost Components

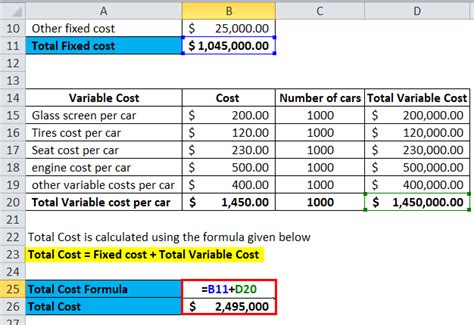

To calculate the total cost easily, it’s essential to understand the various components that contribute to it. These components can be broadly categorized into direct costs, indirect costs, and overheads. Direct costs are directly attributable to the production of a product or service, such as raw materials, labor, and equipment. Indirect costs, on the other hand, are not directly related to the production process but are necessary for the operation of the business, including utilities, salaries of administrative staff, and marketing expenses. Overheads refer to the costs associated with maintaining the business infrastructure, such as rent, insurance, and depreciation of assets.

Direct Cost Calculation

Calculating direct costs involves identifying and quantifying the resources directly used in the production or delivery of a product or service. This can include the cost of raw materials, labor costs (including wages, benefits, and training), and the cost of equipment or machinery. For example, in manufacturing, the direct cost of producing a widget might include the cost of plastic, labor to assemble the widget, and the cost of the machine used in the assembly process.

| Direct Cost Category | Cost per Unit |

|---|---|

| Raw Materials | $5.00 |

| Labor | $3.50 |

| Equipment | $1.00 |

| Total Direct Cost | $9.50 |

Indirect Cost and Overhead Allocation

Indirect costs and overheads are allocated to products or services using various methods, including the absorption costing method and the marginal costing method. The absorption costing method allocates all costs, both direct and indirect, to products, while the marginal costing method only allocates variable costs to products. The choice of method depends on the business’s financial reporting requirements and the nature of its operations.

Technological Solutions for Cost Calculation

The advent of advanced technology and software has made the process of calculating total cost easier and more efficient. Enterprise resource planning (ERP) systems, accounting software, and project management tools offer functionalities that can automate the collection of cost data, perform complex calculations, and provide real-time insights into cost performance. These tools not only reduce the manual effort required for cost calculation but also minimize the risk of human error, leading to more accurate and reliable cost estimates.

Considering External Factors

In addition to the internal cost components, external factors such as inflation, taxes, and market fluctuations can significantly impact the total cost. Inflation, for instance, can increase the cost of raw materials and labor over time, while taxes can add to the overall cost burden. Understanding these external factors and incorporating them into the cost calculation process is vital for maintaining profitability and competitiveness.

Flexible Budgeting

A flexible budgeting system allows businesses to adjust their budgets in response to changes in activity levels or other factors. This approach enables the company to manage its costs more effectively, especially in environments where demand is volatile or subject to seasonal fluctuations. By regularly reviewing and updating the budget, businesses can ensure that their cost structure remains aligned with their operational needs and strategic objectives.

What is the most effective way to calculate total cost for a small business?

+The most effective way for a small business to calculate total cost involves identifying all direct and indirect costs, using a cost calculation method that suits the business's operations, and regularly reviewing and adjusting the cost structure to ensure accuracy and relevance.

How does technology impact the cost calculation process?

+Technology, through the use of specialized software and tools, can significantly streamline the cost calculation process by automating data collection, performing complex calculations, and providing real-time insights into cost performance, thus improving accuracy and efficiency.

What are the key challenges in calculating total cost, and how can they be overcome?

+The key challenges include accurately identifying and allocating indirect costs and overheads, dealing with external factors like inflation, and maintaining flexibility in budgeting. These challenges can be overcome by adopting a thorough and systematic approach to cost calculation, utilizing appropriate technology, and regularly reviewing and adjusting the cost structure.

In conclusion, calculating total cost easily and accurately requires a deep understanding of the various cost components, the ability to apply appropriate cost calculation methods, and the integration of technology to streamline the process. By considering both internal and external factors, adopting flexible budgeting practices, and leveraging technological solutions, businesses can achieve a more precise calculation of their total costs, leading to better decision-making, improved profitability, and enhanced competitiveness in the market.