Emergency loans for bad credit are financial products designed for individuals who require immediate access to funds, despite having a poor credit history. These loans are often characterized by their rapid approval and disbursement processes, flexible repayment terms, and consideration for borrowers with subpar credit scores. The demand for emergency loans has been on the rise, driven by the increasing uncertainty of modern life, where unexpected expenses can arise at any moment, catching individuals off guard. For those with bad credit, traditional lending channels may be inaccessible, making emergency loans a vital lifeline.

The concept of emergency loans for bad credit has evolved significantly over the years, with the emergence of online lenders offering a more streamlined and efficient experience compared to traditional banks. These lenders utilize advanced algorithms to assess creditworthiness, considering factors beyond the conventional credit score, such as income stability, employment history, and other financial metrics. This holistic approach enables a broader range of individuals to access emergency funding, even if they have been turned down by mainstream lenders due to their credit history.

Key Points

- Emergency loans for bad credit provide immediate financial relief for unexpected expenses.

- Online lenders offer more accessible and efficient loan processes compared to traditional banks.

- Flexible repayment terms and considerations for borrowers with poor credit scores are common features.

- Advanced algorithms are used to assess creditworthiness, looking beyond traditional credit scores.

- Emergency loans can be a vital financial tool for managing unexpected expenses and avoiding deeper financial trouble.

Understanding Emergency Loans for Bad Credit

Emergency loans for bad credit come in various forms, including payday loans, installment loans, and title loans, each with its own set of terms and conditions. Payday loans, for example, are short-term loans that must be repaid by the borrower’s next payday, typically within two weeks. They are known for their high interest rates and fees but offer quick access to cash. Installment loans, on the other hand, allow borrowers to repay the loan in installments over a longer period, which can range from a few months to several years. Title loans require the borrower to use their vehicle as collateral, posing a significant risk if the borrower fails to repay the loan.

The process of obtaining an emergency loan for bad credit involves submitting an application, usually online, and providing the required documentation, such as proof of income, employment, and identity. Lenders may also request access to the borrower's bank account or require a postdated check as a form of security. The approval process is typically rapid, with some lenders promising decisions within minutes of applying. Once approved, the funds are usually deposited directly into the borrower's bank account, ready for immediate use.

Considerations and Precautions

While emergency loans for bad credit can offer a lifeline in times of financial distress, they also come with significant risks and considerations. The high interest rates and fees associated with these loans can quickly accumulate, leading to a cycle of debt that is difficult to escape. Borrowers must carefully review the terms and conditions of the loan, understanding the total cost of the loan, including all fees and charges, before agreeing to the loan. It is also crucial to ensure that the lender is reputable and compliant with relevant financial regulations to avoid scams and predatory lending practices.

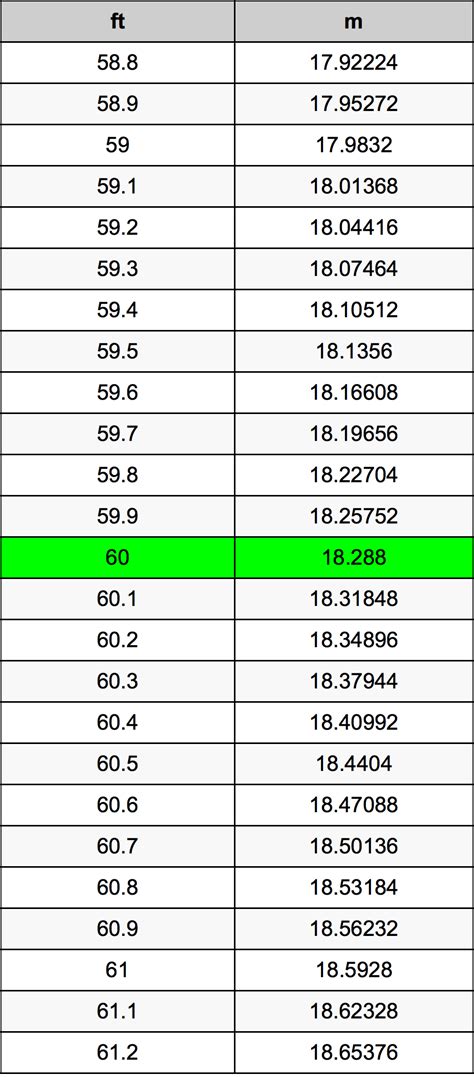

| Loan Type | Interest Rate Range | Repayment Term |

|---|---|---|

| Payday Loans | 300% - 780% APR | 2 weeks |

| Installment Loans | 6% - 36% APR | Several months to years |

| Title Loans | 300% APR | 30 days |

Improving Credit Scores and Reducing Dependence on Emergency Loans

Improving credit scores and reducing dependence on emergency loans require a long-term financial strategy that involves responsible borrowing, timely payments, and a thorough understanding of personal finances. Individuals can start by checking their credit reports for errors, paying bills on time, reducing debt, and avoiding new credit inquiries. Building an emergency fund can also help mitigate the need for emergency loans, providing a cushion against unexpected expenses and financial shocks.

Furthermore, financial literacy plays a critical role in navigating the complex world of personal finance and making informed decisions about borrowing and credit. Educating oneself about different types of loans, understanding the implications of high-interest rates, and being aware of predatory lending practices can empower individuals to make better financial choices and avoid the pitfalls associated with emergency loans for bad credit.

What are the common types of emergency loans for bad credit?

+Common types include payday loans, installment loans, and title loans, each with its own terms and risks.

How can I improve my chances of getting approved for an emergency loan with bad credit?

+Improving your credit score, providing a stable income proof, and choosing lenders that consider more than just credit scores can help.

What are the risks associated with emergency loans for bad credit?

+The high interest rates and fees can lead to a cycle of debt, and predatory lending practices can cause significant financial harm.

In conclusion, emergency loans for bad credit serve as a necessary financial tool for individuals facing unexpected expenses and financial hardships. However, it is crucial for borrowers to approach these loans with caution, understanding the terms, risks, and implications. By making informed decisions, improving financial literacy, and working towards better credit scores, individuals can navigate the challenges of emergency financing more effectively and secure a more stable financial future.