The concept of cross price elasticity is a fundamental aspect of microeconomics, playing a crucial role in understanding the dynamics of consumer behavior and market interactions. It measures the responsiveness of the quantity demanded of one good to changes in the price of another good. This elasticity is essential for businesses and policymakers to comprehend the intricate relationships between different products in a market, allowing them to make informed decisions about pricing strategies, product development, and market regulation. In this article, we will delve into the concept of cross price elasticity, its calculation, interpretation, and practical applications, providing a comprehensive overview of its significance in economic analysis.

Key Points

- Definition and calculation of cross price elasticity of demand

- Interpretation of cross price elasticity values

- Types of related goods: substitutes and complements

- Practical applications in business and policy-making

- Limitations and challenges in estimating cross price elasticity

Understanding Cross Price Elasticity

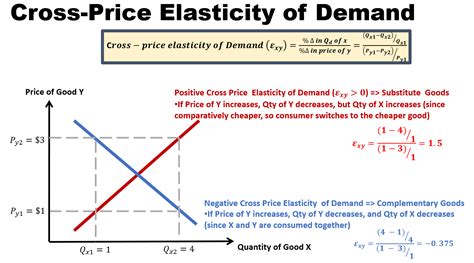

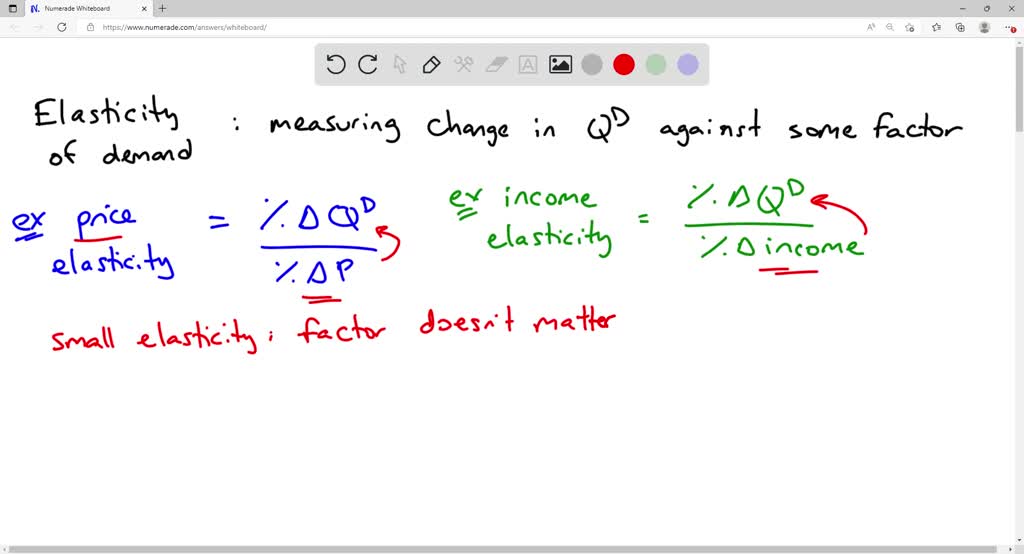

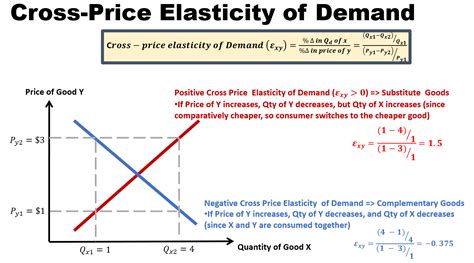

Cross price elasticity of demand is quantitatively measured as the percentage change in the quantity demanded of one good in response to a percentage change in the price of another good. It is calculated using the formula: Cross Price Elasticity = (Percentage Change in Quantity Demanded of Good A) / (Percentage Change in Price of Good B). A positive cross price elasticity indicates that the two goods are substitutes, meaning an increase in the price of one good leads to an increase in the demand for the other. Conversely, a negative cross price elasticity suggests that the goods are complements, where an increase in the price of one good results in a decrease in the demand for the other.

Substitutes and Complements

In the context of cross price elasticity, understanding the nature of the relationship between goods is crucial. Substitutes are goods that can be used in place of each other, such as coffee and tea. An increase in the price of coffee may lead to an increase in the demand for tea, as consumers switch from the more expensive option to the cheaper alternative. On the other hand, complements are goods that are consumed together, like cars and gasoline. An increase in the price of cars would likely lead to a decrease in the demand for gasoline, as fewer cars are purchased and, consequently, less gasoline is consumed.

| Type of Goods | Cross Price Elasticity Sign | Example |

|---|---|---|

| Substitutes | Positive | Coffee and Tea |

| Complements | Negative | Cars and Gasoline |

Practical Applications

The concept of cross price elasticity has numerous practical applications in business and policy-making. For instance, companies can use cross price elasticity analysis to inform their pricing strategies, taking into account the potential impact of price changes on related products. Policymakers can also apply this concept to design more effective tax policies or regulations that consider the interactions between different markets. Furthermore, understanding cross price elasticity can help businesses identify opportunities for product bundling or joint promotions, enhancing their competitive edge in the market.

Challenges and Limitations

Despite its importance, estimating cross price elasticity can be challenging due to the complexity of market interactions and the need for high-quality data. The accuracy of cross price elasticity estimates depends on the quality of the data used, the specification of the econometric model, and the control for other factors that might influence the relationship between the goods. Additionally, cross price elasticity can vary over time due to changes in consumer preferences, income, or other market conditions, requiring continuous monitoring and updating of estimates.

What is the significance of cross price elasticity in market analysis?

+Cross price elasticity is crucial for understanding how changes in the price of one product affect the demand for another, allowing businesses and policymakers to make informed decisions about pricing, product development, and market regulation.

How do substitutes and complements differ in terms of cross price elasticity?

+Substitutes have a positive cross price elasticity, indicating that an increase in the price of one good leads to an increase in the demand for the other. Complements have a negative cross price elasticity, meaning an increase in the price of one good results in a decrease in the demand for the other.

What are some challenges in estimating cross price elasticity?

+Estimating cross price elasticity can be challenging due to the need for high-quality data, the complexity of specifying the correct econometric model, and the requirement to control for other factors that might influence the relationship between goods. Additionally, cross price elasticity can vary over time, necessitating continuous monitoring and updating of estimates.

In conclusion, cross price elasticity is a vital concept in economics that helps understand the interactions between different goods in a market. By analyzing the cross price elasticity of demand, businesses and policymakers can gain insights into consumer behavior, make informed decisions, and develop effective strategies to achieve their objectives. Despite the challenges in estimating cross price elasticity, its significance in market analysis and decision-making cannot be overstated, underscoring the need for ongoing research and refinement in this area.