Auto insurance is a critical aspect of vehicle ownership, providing financial protection and peace of mind for drivers and vehicle owners. While liability insurance is mandatory in many jurisdictions, comprehensive auto insurance offers an additional layer of coverage, safeguarding against a wide range of unexpected events. This article aims to delve into the intricacies of comprehensive auto insurance, exploring its benefits, coverage details, and considerations to help readers make informed decisions.

Understanding Comprehensive Auto Insurance

Comprehensive auto insurance, often referred to as “full coverage,” is an optional add-on to the standard liability insurance policy. While liability insurance primarily covers damages caused to others in an accident, comprehensive insurance extends protection to cover damages to the insured vehicle from various non-collision-related events.

This type of insurance is designed to offer a comprehensive safety net, ensuring that vehicle owners are not left with substantial out-of-pocket expenses in the event of unforeseen circumstances. It covers a broad spectrum of incidents, from natural disasters to vandalism and even certain types of theft.

Key Benefits of Comprehensive Coverage

One of the most significant advantages of comprehensive auto insurance is the broad range of incidents it covers. Here are some of the key benefits:

- Natural Disasters: Comprehensive insurance typically covers damages caused by natural calamities such as floods, hurricanes, tornadoes, and earthquakes. This is particularly beneficial for drivers living in regions prone to such events.

- Vandalism and Theft: It provides coverage for instances of vandalism, where the vehicle is intentionally damaged, and for certain types of theft, ensuring financial protection in unfortunate situations.

- Animal Collisions: While it may not cover all animal-related incidents, comprehensive insurance often includes coverage for damages caused by collisions with animals, which can be a common occurrence in certain areas.

- Falling Objects: Incidents involving falling objects, such as tree branches or debris from construction sites, are often covered by comprehensive insurance, providing an extra layer of protection for drivers.

- Glass and Windshield Damage: Comprehensive coverage typically includes repairs or replacements for damaged windshields and glass, which can be costly to fix out-of-pocket.

- Fire and Explosions: In the unfortunate event of a fire or explosion, comprehensive insurance steps in to cover the cost of repairs or replacements, ensuring the vehicle owner is not left with a total loss.

By offering protection against these diverse incidents, comprehensive auto insurance provides a robust safety net for vehicle owners, ensuring their financial stability and peace of mind.

Coverage Details and Considerations

While comprehensive auto insurance offers extensive coverage, it’s important to understand the specifics and potential limitations of this type of policy.

Covered Incidents and Exclusions

Comprehensive insurance covers a wide range of incidents, but there are also specific exclusions to be aware of. These may include:

- Routine Maintenance: Comprehensive insurance does not cover routine wear and tear, mechanical breakdowns, or maintenance issues. These are typically considered the responsibility of the vehicle owner.

- Certain Types of Theft: While comprehensive insurance covers theft, it may not cover all instances. For example, it often excludes theft of personal belongings left inside the vehicle.

- Hit-and-Run Accidents: In the event of a hit-and-run, comprehensive insurance may cover the damages, but it's essential to understand the specific policy conditions and requirements for making a claim.

- Specific Natural Disasters: Some natural disasters, such as landslides or sinkholes, may not be covered by standard comprehensive insurance policies. It's crucial to review the policy details to understand the coverage scope.

Policy Deductibles and Limits

When selecting a comprehensive auto insurance policy, it’s important to consider the deductibles and coverage limits. A deductible is the amount the policyholder pays out-of-pocket before the insurance coverage kicks in. For example, if the deductible is 500 and the repair cost is 2,000, the policyholder pays 500, and the insurance company covers the remaining 1,500.

Coverage limits, on the other hand, refer to the maximum amount the insurance company will pay for a covered incident. These limits are typically set for different types of coverage, such as collision, comprehensive, and liability. It's crucial to select limits that align with the value of the vehicle and the desired level of protection.

Comparing Quotes and Selecting the Right Policy

Shopping around for comprehensive auto insurance quotes is essential to find the best coverage at a competitive price. Different insurance providers offer varying levels of coverage and pricing, so it’s beneficial to compare multiple quotes. Consider factors such as the provider’s reputation, financial stability, and customer service ratings when making your decision.

Additionally, be mindful of any discounts or incentives offered by insurance providers. Some common discounts include multi-policy discounts (bundling auto and home insurance), good student discounts, safe driver discounts, and loyalty discounts for long-term customers.

Performance Analysis and Industry Insights

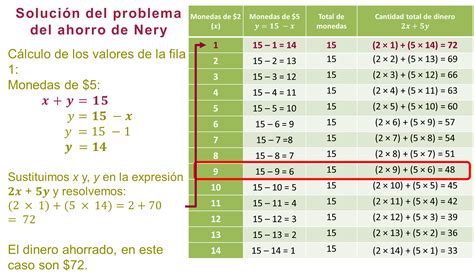

Comprehensive auto insurance has become increasingly popular among vehicle owners, with a growing number of drivers recognizing the value of this additional coverage. Industry data reveals a steady increase in comprehensive insurance uptake over the past decade, indicating a shift towards more comprehensive protection.

| Year | Percentage of Vehicles with Comprehensive Coverage |

|---|---|

| 2015 | 52% |

| 2016 | 54% |

| 2017 | 56% |

| 2018 | 58% |

| 2019 | 60% |

This trend is particularly noticeable among younger drivers, who are more likely to opt for comprehensive coverage compared to older generations. Industry experts attribute this shift to increased awareness of the benefits of comprehensive insurance, as well as the growing affordability of this coverage option.

Future Implications and Emerging Trends

The landscape of auto insurance is continually evolving, and comprehensive insurance is no exception. As technology advances, we can expect to see new trends and innovations shaping the industry.

Telematics and Usage-Based Insurance

Telematics refers to the use of technology to track and analyze driving behavior. This technology is already being utilized in usage-based insurance policies, where premiums are determined based on actual driving habits rather than static factors like age or location. As telematics becomes more prevalent, we can expect to see comprehensive insurance policies incorporating this data to offer more personalized and dynamic coverage.

Connected Car Technology

The rise of connected car technology, where vehicles are equipped with advanced sensors and communication systems, presents new opportunities for comprehensive insurance. These vehicles can provide real-time data on driving behavior, vehicle health, and even potential accident scenarios. This data can be used to enhance comprehensive insurance policies, offering more accurate risk assessments and potentially reducing premiums for safe drivers.

Sustainability and Electric Vehicles

With the increasing popularity of electric vehicles (EVs), comprehensive insurance policies are adapting to meet the unique needs of EV owners. EV-specific coverage options are emerging, addressing concerns such as battery degradation, charging infrastructure, and the potential for higher repair costs due to specialized components. As the EV market continues to grow, we can expect comprehensive insurance to evolve further to accommodate these vehicles.

Conclusion

Comprehensive auto insurance is a valuable tool for vehicle owners, providing protection against a wide range of unforeseen incidents. By understanding the benefits, coverage details, and emerging trends, drivers can make informed decisions to ensure they have the right level of protection for their needs. As the auto insurance industry continues to evolve, comprehensive insurance will play a pivotal role in safeguarding drivers and their vehicles in an ever-changing landscape.

Frequently Asked Questions

How does comprehensive auto insurance differ from collision insurance?

+Collision insurance covers damages to your vehicle resulting from a collision with another vehicle or object, regardless of fault. Comprehensive insurance, on the other hand, covers a broader range of incidents, including natural disasters, theft, and vandalism, among others. While collision insurance is often required if you have a loan or lease on your vehicle, comprehensive insurance is optional.

What is the average cost of comprehensive auto insurance?

+The cost of comprehensive auto insurance can vary widely depending on several factors, including your location, the make and model of your vehicle, your driving history, and the insurance provider. On average, comprehensive coverage can range from 100 to 300 per year, but it’s important to obtain quotes from multiple providers to find the best rate for your specific circumstances.

Can I get comprehensive insurance for an older vehicle with low market value?

+Yes, comprehensive insurance is available for older vehicles, regardless of their market value. However, it’s important to consider the cost of the insurance relative to the value of the vehicle. In some cases, the cost of comprehensive insurance may exceed the potential benefits, especially if the vehicle has a low market value. Consulting with an insurance professional can help you make an informed decision.

What happens if I have a comprehensive claim and my vehicle is deemed a total loss?

+If your vehicle is declared a total loss due to a covered incident under your comprehensive insurance policy, the insurance company will typically pay you the actual cash value of the vehicle at the time of the loss. This means you’ll receive a payment based on the vehicle’s fair market value, taking into account factors like its age, mileage, and condition. It’s important to note that the actual cash value may be less than the amount you still owe on a loan or lease, so you may need to cover the difference out of pocket.

Are there any discounts available for comprehensive auto insurance?

+Yes, there are several discounts that may be applicable to comprehensive auto insurance. These can include multi-policy discounts (bundling auto and home insurance), good student discounts for young drivers with good grades, safe driver discounts for accident-free records, and loyalty discounts for long-term customers. It’s worth exploring these options to potentially reduce your comprehensive insurance premiums.