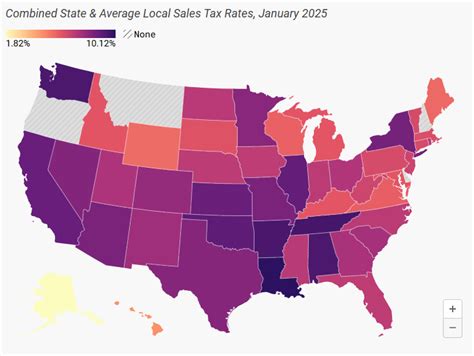

Arizona sales tax rates are a crucial aspect of the state's fiscal policy, affecting both businesses and consumers. As of 2023, the state of Arizona imposes a statewide sales tax rate of 5.6%. However, this rate can vary significantly depending on the location, with additional local sales taxes applied by counties, cities, and other special taxing districts. Understanding these rates is essential for businesses to navigate the complexities of sales tax compliance and for consumers to make informed purchasing decisions.

Key Points

- The statewide sales tax rate in Arizona is 5.6%.

- Local sales taxes can add up to 5.125% to the total sales tax rate, depending on the location.

- The total sales tax rate in Arizona can range from 5.6% to 10.725%.

- Some cities and counties may have additional taxes on specific goods or services.

- Businesses must register for a Transaction Privilege Tax (TPT) license to collect and remit sales taxes.

Understanding Arizona Sales Tax Rates

Arizona’s sales tax system is designed to distribute the tax burden across various levels of government. The statewide rate of 5.6% is the foundation, but counties and cities can impose additional taxes. For instance, Maricopa County, where Phoenix is located, adds a 0.7% tax, while Pima County, home to Tucson, adds a 0.5% tax. These local taxes are used to fund various public services and infrastructure projects. It’s worth noting that some areas may have higher combined sales tax rates due to the presence of special taxing districts, such as transportation or hospital districts.

Local Sales Tax Rates

Local sales tax rates in Arizona vary significantly, reflecting the diverse economic and demographic profiles of different regions. For example, the city of Phoenix has a total sales tax rate of 8.6%, which includes the state rate, the county rate, and a city-specific rate. In contrast, the city of Flagstaff has a total sales tax rate of 9.91%, which includes a higher city-specific rate to support local services and infrastructure. Businesses operating in multiple locations must be aware of these variations to ensure compliance with all applicable tax laws.

| Location | State Rate | County Rate | City Rate | Total Rate |

|---|---|---|---|---|

| Phoenix | 5.6% | 0.7% | 2.3% | 8.6% |

| Tucson | 5.6% | 0.5% | 2.5% | 8.6% |

| Flagstaff | 5.6% | 0.25% | 4.09% | 9.94% |

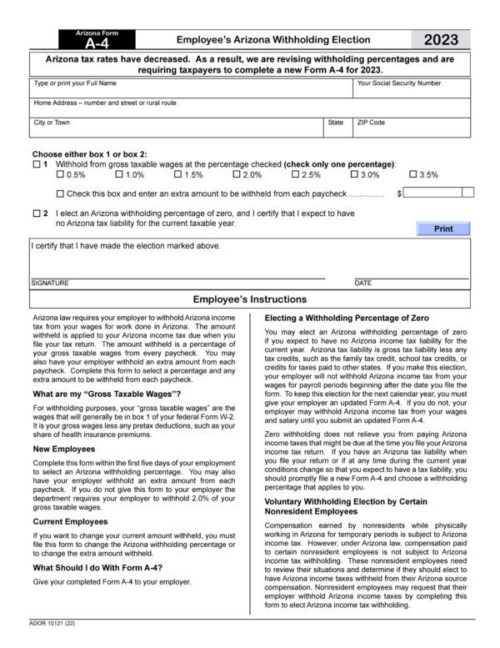

Transaction Privilege Tax (TPT)

The Transaction Privilege Tax (TPT) is essentially Arizona’s version of a sales tax, focusing on the privilege of doing business in the state rather than the sale itself. Businesses must register for a TPT license to legally collect and remit sales taxes. The TPT rate mirrors the sales tax rate, including both state and local components. This approach simplifies tax compliance for businesses operating across multiple jurisdictions within Arizona, as they only need to account for the varying local rates in addition to the statewide rate.

TPT Licensing and Compliance

Obtaining a TPT license is a straightforward process, typically involving an online application through the Arizona Department of Revenue’s website. Businesses must provide basic information about their operations, including location, type of business, and estimated annual sales. Once licensed, businesses are responsible for filing regular sales tax returns, usually on a monthly or quarterly basis, depending on their sales volume. Penalties for non-compliance can be significant, making it essential for businesses to prioritize accurate and timely tax reporting.

Arizona's sales tax landscape is complex, with rates varying by location and type of goods or services. For consumers, understanding these rates can help in making purchasing decisions, especially for large-ticket items. For businesses, compliance with sales tax laws is not only a legal requirement but also crucial for maintaining a competitive edge and avoiding the financial burden of non-compliance penalties. As Arizona continues to grow economically, its sales tax system will likely evolve, necessitating ongoing vigilance from both businesses and consumers to navigate these changes effectively.

What is the current statewide sales tax rate in Arizona?

+The current statewide sales tax rate in Arizona is 5.6%.

How do local sales taxes work in Arizona?

+Local sales taxes in Arizona are added to the statewide rate, with counties and cities imposing their own taxes. These rates can vary significantly, depending on the location.

What is the Transaction Privilege Tax (TPT), and how does it relate to sales tax in Arizona?

+The Transaction Privilege Tax (TPT) is Arizona’s equivalent of a sales tax, focusing on the privilege of doing business. Businesses must register for a TPT license to collect and remit sales taxes, with rates mirroring the sales tax rates, including both state and local components.